Chart of the Week: Vietnamese banks are downplaying their problem loans

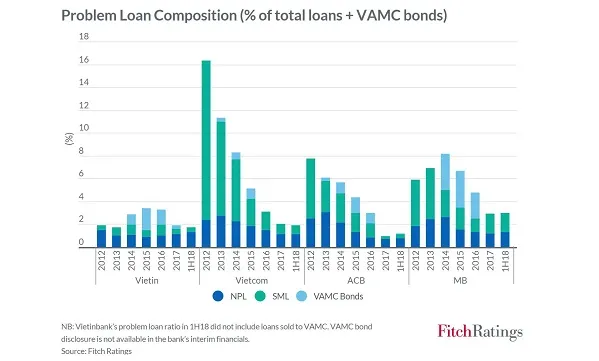

Vietinbank, for instance, reports an NPL ratio of 1.4% but the true figure is at least 3%.

Banks in Vietnam may be understating the true status of their asset quality as most local banks report low problem loan ratios in September 2018, according to Fitch Ratings.

Also read: Vietnamese banks step up bad loan disposal via auction

Vietinbank, for instance, reported a healthy non-performing loan ratio of only 1.4% which rises up to 1.7% with the inclusion of special mention loans although the truer figure is likely much steeper.

"We believe the true problem-loan ratio is at least 3%, but it could be much higher," Wee Siang Ng, senior director for financial institutions at Fitch Ratings said in a report. "Weak asset quality weighs on Vietinbank's credit profile, as with other Vietnamese banks."

That is not to say that the country's lenders have not been making headway in resolving their bad debt as Vietcombank, ACB and Military Bank have been steadily reporting progress in cleaning up their balance sheets. Banks shed over $6.4b in bad loans in 2018 to bring down the sector's NPL ratio to 1.89% in 2018 from 1.99% in the previous year, according to a report from Viet Nam News.

Also read: Vietnamese banks' 2018 pre-tax profit surges 40% as bad debt crackdown pays off

Ng notes that the industry-wide effort is facilitated by the supportive trends in the property market and the passing of Resolution 42 which is aimed at improving the debt-resolution environment by strengthening banks' ability to foreclose assets.

"Recognition of problem loans would increase the transparency of the balance sheet, while progress on resolving bad loans could eventually improve underlying health," she said. "Effective implementation of a balance-sheet clean-up would be a positive step, but there is still uncertainty about if and when this review will lead to full recognition of problem loans at either a bank or system level."

Advertise

Advertise