Malaysian banks bear weight of $234b household debt burden

Lower income borrowers account for 37% of household loans.

Banks in Malaysia are shouldering the heavy burdens of $234.10b (MYR972b) in household exposure which account for 58% of gross loans, according to a report from Fitch Ratings.

Although household debt only grew by 4.7% in 2018 from 4.9% in 2017 and 9.4% in 2014 - a pace slower than the growth of nominal GDP - to settle at 83% of national output by the end of the year, the scenario remains fragile especially with lower-income borrowers posing a threat to the stabilising credit situation.

Also read: Crowdfunding flourishes in Malaysia as banks reject loan applications

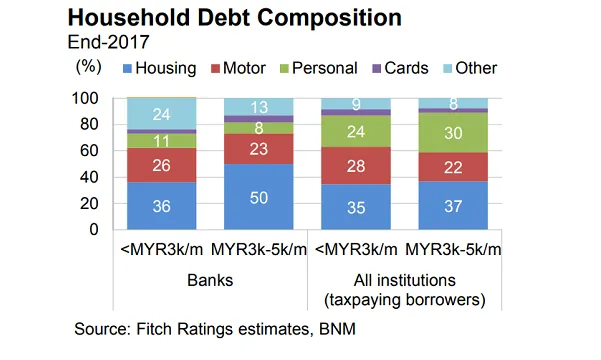

Those earning up to $1,204 (MYR5,000) a month account for 37% of banks' household loans and an even larger proportion for non-banks.

"Whilst banks’ exposure to such borrowers tend to be secured (housing, motor or other), loan-to-value (LTV) ratios can be high, weakening recovery prospects in default. About 28% of banks’ home loans have LTV ratios over 80%," the firm said in a report.

Moreover, personal-loan impairment ratios remain higher than five years ago (1.8%; all household loans: 1.0%), and have been a rising cause of bankruptcy in recent years.

In fact, the central bank estimates that a 10% decline in household incomes could raise bank credit losses by $11.56b (MYR48b) which exceeds 2018 sector pre-tax profit of $8.91b (MYR37b), and compares with total capital of $68.64b (MYR285b) at end-April 2019. "Lower incomes would weaken consumption and GDP growth, broadening potential losses," noted Fitch Ratings.

However, household leverage is tipped to decline further as the economy grows and healthy bank capitalisation with common equity Tier 1 ratio: 13.5% at end-April will provide a slight buffer against growing downside risks.

Advertise

Advertise