South Korea’s deposit, loan interest rates dip in June

Average interest rates for new and outstanding loans and deposits fell.

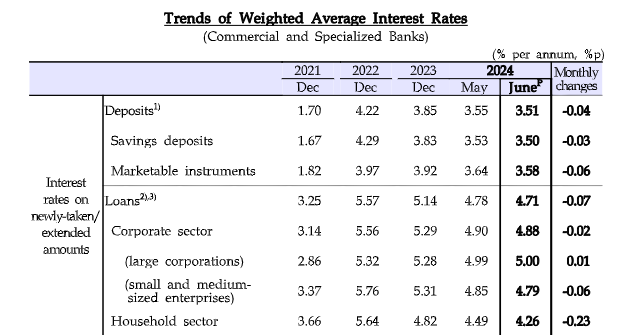

The interest rate of deposits held by South Korean banks fell 4 basis points (bp) to 3.51% in June compared to May, based on data from the Bank of Korea (BOK).

The average interest rate on new loans also fell 7 bp to 4.71% compared to May, South Korea’s financial regulator said in a report published in July 2024.

Average interest rate of outstanding amounts of deposits was 2.6% in end-June, declining by 3bp.

Meanwhile, the average interest rate on outstanding amounts of loans was 4.96%, a 5 bp decrease, the BOK said.

Advertise

Advertise