Lending & Credit

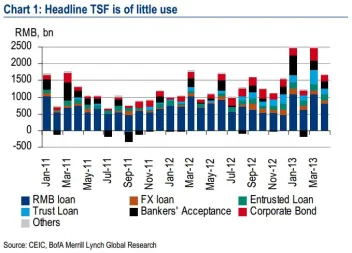

Why headline TSF is 'of little meaning' to calculate China's credit growth

Why headline TSF is 'of little meaning' to calculate China's credit growth

It's a 'second derivative' of credit.

Shadow banking creating China's worst credit bubble

Deflation is a possibility.

Chinese government becoming less dependent on bank financing

Borrowing from corporates increased surged 125% to RMB1,114b.

BOJ prods banks to hike businesses lending

Launches new, low-interest lending program.

Indonesia acts to stem rupiah’s plunge

Raised Fasbi to 4.25% yesterday.

Taiwan boosts position as offshore renminbi hub

Deutsche Bank becomes first foreign bank to raise renminbi in Taiwan.

New RMB loans down to RMB 667b in May

Growth was offset by the low ST corporate loans.

More Philippine banks to list on PSE

Financial sector outperforming the main PSE index.

PBOC warns anew against shadow banking

Says there is a need to strengthen disclosure.

New Chinese bank loans fall 9%

Drops to US$107.6 billion in May.

Shanghai to trial renminbi convertibility

Intends to to test convertibility at the Qianhai zone.

China extends freeze on IPOs

Continuing hike in bad loans forces extension.

India moves against rising restructured debt risk

Orders banks to boost reserves to 5% from 2.75%.

What Asian banks need to know about customers' trust and fair treatment (Part 2)

In Part Two of a special series of reports regarding conduct risk and consumer protection regulations, we continue with a brief history on the...

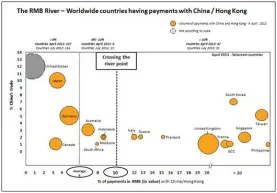

More countries use RMB for more than 10% of their payments with China and Hong Kong

There are now 47 countries worldwide.

Singapore eager for more renminbi business

First MAS representative office in Beijing good for commercial banks.

China's shadow banking danger to escalate in 2015

Moody's sees no immediate meltdown in China's shadow banking, however.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership