Australia

ASB Bank agrees to pay $78.89m to settle lawsuit

ASB Bank agrees to pay $78.89m to settle lawsuit

The bank maintains that “it makes no admission of liability.”

NAB has given out $2b in new green business loans

Demand has surged from businesses related to energy, EVs, property, and agriculture.

Westpac mobile app rated best in Australia by Forrester

Actionable recommendations and prompts to avoid fees helped propel it to the top spot.

Westpac launches SafeBlock in online banking platform and app

Scam losses have reportedly fallen 19% in 2025 so far.

Australian regulator’s private credit scrutiny supports market stability: analyst

Better transparency, reporting, and oversight will strengthen the market.

Regulator urges stronger standards in Australia's private credit sector

A review found opaque remuneration and fee structures, amongst other concerns.

CBA says RBA interchange reforms risk hurting Aussie firms

The Australian bank agreed that debit and credit surcharging should be eliminated.

CBA’s x15ventures teams up with fintech fund Triple Bubble

They will develop a mentorship and talent exchange program.

NAB boards mourns passing of former director David Armstrong

Armstrong was with NAB from 2014-2023.

ANZ sets up resolution program, to submit remediation plan

ANZ could spend approximately A$150m on implementing the remediation plan.

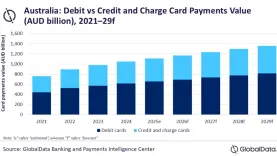

Chart of the Week: Debit card fuel growth of Australia’s card payments market

Australians are choosing to spend within their means instead of accruing debt.

RBA sets out plan to make payments system ‘anti-fragile’

It has also warned that delays in encryption and contingency plans risk fraud and disruption.

ASIC eases disclosure rules on deposit rates for banks

The relief is extended until 1 October 2030.

ANZ fined $240m for incorrect trading reporting and misconduct

This is the largest ever announced by ASIC against one entity.

ANZ’s CRO Kevin Corbally to step down

He will serve as the Managing Director of Capital Management of the bank’s Institutional Division.

Australia extends relief on appointing deposit and insurance distributors

The exemption has been extended until 27 August 2030.

Stripe Capital to launch in Australia

Over 1 million users in the ANZ region now run on Stripe, the company said.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership