China

Chinese deposits shift from brokers to banks and wealth management products

Chinese deposits shift from brokers to banks and wealth management products

Total deposits grew faster by CNY0.9t MoM in Sep 2015.

BEA China joins the PBOC's Cross-border Interbank Payment System

The CIPS is a clearing system for cross border RMB payments.

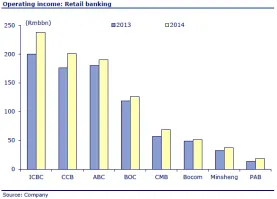

Who's winning China's retail banking race?

The top bank raked in RMB238 billion in 2014.

China banks face escalating operating pressure up to two years

As the country's economic growth reduces speed.

Here's why BOC's 1% profit growth is likely a one-off phenomenon

Weaker revenue momentum is lurking.

China banks still suffering from sluggish corporate loans

Weak economic demand to blame again.

China Construction Bank beats peers with internet offerings

Its conversion rate for online customers is 57%.

Chinese banks expected to grow loans faster than deposits

As the 75% LDR ceiling has been abolished.

China beats France, Japan in housing the world's largest banks

French and Japanese banks elbowed out of top five.

China's shadow banking activities growing at rapid pace

Even amidst tighter regulations.

China's 75% LDR to be removed as regulatory requirement

The State Council has approved the proposal.

V-shaped recovery experienced by CNH bonds in 1H2015

They're likely to perform resiliently in 2015.

China's ditching of loan-to-deposit ratio requirement a welcome development

But with limited short-term impact.

China Construction Bank, Euroclear ink MOU on offshore RMB financial products

Regarding a global RMB financial products platform.

APAC banks threatened by China's economic slowdown, rebalancing

As if household leverage and US rate hike aren't scary enough.

Non-residents hold CNY4.4 trillion worth of total RMB denominated assets

Up from CNY2.88 trillion in 2013.

China steps up focus on reforming cross-border investment schemes

A bid to open up China's capital account.

Advertise

Advertise

Commentary

Fighting fraud in the digital banking age

Asian banking’s next frontier: Beyond growth, embracing precision

Rethinking cybersecurity: How APAC banks can safeguard against AI-powered threats

Why Singapore’s fast payments need faster protections