China

China bank lending increases 6% in August

But growth will likely moderate towards yearend.

ICBC, Western Union deal to benefit 400 million ICBC customers

Also launch program allowing international bank transfers from 23 countries.

PBOC's total social financing rebounded to RMB1.57tn in August

Here are 3 growth drivers.

China banks predicted to curb interbank transactions in 2H13

What could be its impact?

China and Hungary sign FX swap deal

Swap is worth US$1.62 billion.

HSBC the first foreign bank to complete two-way cross-border RMB lending

Under a new pilot programme in Kunshan.

Check out BofAML's enhanced China trade and supply chain finance product suite

Its Electronic Commercial Draft System expands.

RMB trade settlements hit RMB2.05 trillion in H1

It’s a record for one semester.

Chinese banks forge ahead with overseas expansion

They now have 1,050 overseas outlets.

Joint efforts vital to curbing risks in China's banking sector

China pushes for more coordination among regulatory agencies.

China to strengthen financial ties with ASEAN

Needed to safeguard regional financial stability.

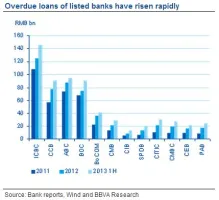

Why you must not be fooled by Chinese banks' good 1H13 profit results

The sharp overdue loans increase suggest weak underlying trends.

Deutsche Bank unveils new branch in Qingdao

It's the bank's sixth branch in China.

China orders tighter monitoring of banks’ factoring business

Focus is on loans made against accounts receivable.

BofA begins final exit from China Construction Bank

Selling-off US$1.5 billion stake.

ICBC's total deposits of RMB14.5t in 1H13 driven by time deposits

Total loans grew by7.2% in 1H13 to RMB9.4t.

Advertise

Advertise

Commentary

Why APAC banks must rethink their approach to the cost reduction challenge

Thailand backs major conglomerates for digital banks but risks stifling innovation