China

ICBC executive appointed head of CIC

ICBC executive appointed head of CIC

Li Xiaopeng heads China’s sovereign wealth fund with over US$410 billion in assets.

New rules dampen demand for WMPs

These also threaten banks’ profits, however.

China to liberalize interest rates further

Aim is to allow the financial sector to better serve the real economy.

Local government debt remains grave challenge to China’s banking system

Debts are a heavy burden on public finance.

CCB buys stake in 2nd biggest Russian bank

China Construction Bank among buyers of a 55% stake in VTB Bank.

ICBC loses Goldman Sachs investment

US investment firm makes US$1.1 billion by selling remaining ICBC shares.

AgBank VP fired for taking huge bribes

Yang Kun is highest-ranking bank executive to be investigated for corruption.

Urgent action needed to solve China’s massive debt problem

Inaction could result in a damaging hard landing for the economy.

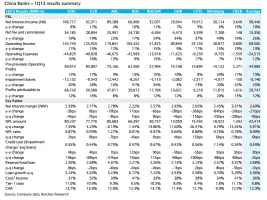

Here's how China banks fared in 1Q13

Gap between big banks and JSBs narrowed.

5 signs that ICBC will outperform in 2013

It has defensive profitability and pricing power.

Chinese banks threatened by sixth straight quarter of rising NPL since 2011

NPL ratio rose to 0.96% by end-March.

IMF warns China over fragile banks

Fears Chinese banks are incapable of withstanding multiple crises.

Chinese banks should do more online business

Ernst & Young also recommends they develop their intermediary business.

PBOC closes WMP loophole

Loophole used by non-bank financial institutions to hide WMP risks.

2 key negative catalysts for China banks

Barclays believes these are well flagged.

Fearless forecast: China banks' net profits and growth rates till 2015

A single-digit growth looms for 2015.

BofAML the first foreign bank to launch cash management alliance with China UnionPay

BAML's head of treasury product Faisal Ameen gives us some exclusive information on the alliance.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership