Hong Kong

HSBC appoints new head of internal audit

HSBC appoints new head of internal audit

HSBC has appointed Manveen Pam Kaur as Group Head of Internal Audit effective April 1.

RMB deposits in Hong Kong rose by 5.6% to RMB603b

It's 9.1% of total deposits.

Hong Kong banks' system loans up 9.6% in 2012

Thanks to trade finance and China-related lending.

HKMA warns of fraudulent website

Some fraud is pretending to be HSBC.

Hong Kong enhances ATM services security

A new security feature will take effect in March.

Hong Kong banks' trade finance to grow 20% in 2013

It's also expected to be more China-biased.

Hong Kong banks threatened by intensifying competition from foreign banks

Aggressive Chinese banks increased their presence in Hong Kong from 9% to 15%.

China eyes Pakistan microfinance banking model

Pakistan says microfinancing system can benefit China.

China Development Bank's Liu Hao back in Beijing

He was the head of the Hong Kong branch.

Renminbi deposits in Hong Kong surge

Amount is 10 times higher than 2009.

Standard Chartered RMB globalisation index rebounded in November

It hit a new high of 737.

DBS Hong Kong launches first RMB Index for VVinning Enterprises

It tracks the actual usage of RMB among Hong Kong companies.

HKMA to consult banks about phases-in LCR

Wants banks not to weaken liquidity to comply with Basel III.

Excess CNH liquidity won't be an issue: BOCHK

Hong Kong banks can easily transfer CNH to their mainland subsidiaries.

China Everbright Bank granted licence in HK

There are now 155 licensed banks in Hong Kong.

HKMA warns of fraudulent website

No, www.winghggroup.com is not the official website of Wing Hang Bank.

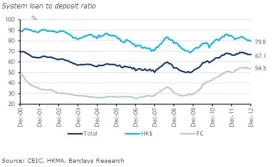

Hong Kong banks' loan-to-deposit ratio stable at 67.3%

And funding costs eased slightly to 34bps.

Advertise

Advertise