Hong Kong

The ultimate key to credible financial forecasts

The ultimate key to credible financial forecasts

How many of you can identify with the organisational environment described below?

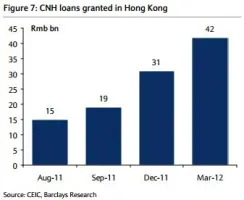

CNH loans granted in Hong Kong reaches RMB 42b

The 3-5% CNH lending rates in Hong Kong still prove to be more attractive than CNY lending rates in China.

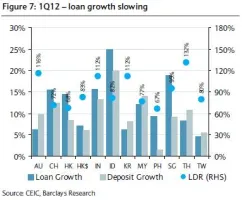

Loan growth in Asia slows in 1Q12

Eight of twelve banking markets across the region saw decelerating loan growth which caused improving funding gaps in Asia.

RMB liquidity facility to open in HK

A facility for providing Renminbi liquidity to authorized institutions in Hong Kong has been unveiled by the Hong Kong Monetary Authority.

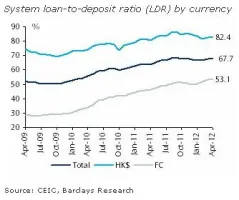

Hong Kong banks' loan-to-deposit ratios remain elevated

Foreign currency LDR remained high at 53.1%, on the back of US$- and CNH-denominated loan demand, says Barclays.

Indian financial industry to spend $6.8B on IT

The Indian financial services industry will spend Rs 37,700 crore or US$6.8 billion on IT products and services in 2012.

StanChart issues RMB 1 million in ECP

A new issuance programme from Standard Chartered Bank provides a new instrument and market for investors in the renminbi.

HKMA, Bank Negara and Euroclear Bank launches joint post-trade service

They aim to process cross-border Asian debt securities transactions centrally via a single link through the Common Platform.

Are your banking skills in demand?

Demand remains steady for candidates across Asia’s banking and finance sector despite the current global economic conditions. Here Marc Burrage, Regional Director of Hays in Hong Kong, discusses trends and current opportunities across Asia from the latest Hays Quarterly Report.

Moody’s rates Hong Kong’s and China’s banking industry

Ratings agency Moody's Investors Service affirms the stability of the banking system in Hong Kong and China.

ECB’s LTRO program

When you create a loan program to save the EU banks and make its participation voluntary, every one of those 523 banks that participates is basically admitting that they have a problem.

"We are in growth mode for funds services in Asia": Citi's Cheeping Yap

Yap, Citi's new head of fund services, aims to expand Citi's fund services to China and Korea, and change some systems.

Wing Hang Bank profit up 30%

Net profit for fiscal year 2011 was HK$2.1b.

HSBC confident of strong growth in 2012-2013

Year 1 in a three-year strategy that should eventually see HSBC become the world’s leading international bank seems to have gotten off to a galloping start.

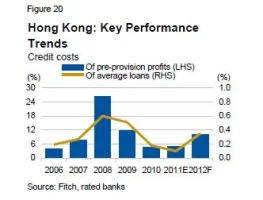

Graph of the Week: Higher credit costs to hit Hong Kong in 2012

Blame it on lower global economic activity, weakening domestic property markets, and higher inflation.

Worries over funding costs in Hong Kong loom in 2012

Given the challenges in credit growth and deposit, Fitch warns of some increase in funding costs.

BEA shows its appetite for dim sum bonds

Bank of East Asia Ltd, Hong Kong’s largest independent local bank and third largest bank, expects to issue up to one billion in dim sum bonds this year.

Advertise

Advertise