Singapore

Trade finance to be a significant revenue stream in Asia: DBS

Trade finance to be a significant revenue stream in Asia: DBS

Banks may also see opportunities in open account trade or supply chain finance despite economic instability.

ANZ to launch online cash management platform in late 3Q12

ANZ Transactive will allow real-time checking of current balances and approving or rejecting key payments.

DBS' Peter Triggs to focus on private banking for clients in Middle East and Europe

As DBS' new managing director, head of international clients and wealth structuring, Triggs will be recruiting bankers with strong international linkages.

Singapore banks' profit to slump 18% in 2Q12

The large trading gains in 1Q will unlikely be repeated this time around.

Rumours of the death of the bank branch have been greatly exaggerated

The global banking industry is pretty much at an all time low in terms of reputation. Nowhere is this so true as in the UK, where it might have been thought that public opinion of the banks could hardly have sunk any lower in the aftermath of the financial crisis that has enveloped the global economy since 2008. But in the past few weeks a processing malfunction at RBS seriously affected millions of customer accounts, while the Libor rate-fixing scandal that has claimed the jobs of Barclays Chairman, Marcus Agius and Chief Executive, Bob Diamond.

Who's banking Asia's millionaires?

Private banks are in for a competitive market to serve Asia's rich with a whopping wealth of US$10.7 trillion.

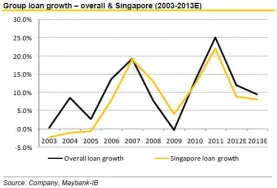

Singapore loan growth to taper off to 8% in 2012

UOB's loan growth is also like to trend towards the lowteens of 10-12%.

How can banks customize their service model to cater to each client's needs?

Bankers say there is no 'one size fits all' solution nowadays.

RBS pulls out of Singapore Libor panel

Royal Bank of Scotland pulled out of a Singapore panel setting interbank lending rates.

Overhauling the weak segments of the Spanish financial sector

Supervision of Spain’s troubled banking system has now passed largely into the hands of inspectors drawn from the European Commission, the IMF, the European Central Bank (ECB) and the European Banking Authority (EBA). This follows agreement by the European authorities to provide Spanish banks directly with up to €100bn of new capital via the EFSF bailout fund.

The difference between a bank's product vs service

Many banks across the Asia Pacific (APAC) geography are implementing Core Banking products. These banks expect that a modern Core Banking product would give them a competitive edge, the ability to launch new products faster, lower operational costs and improve customer service. Unlike Europe or America, which are large with fairly standard banking offerings, the APAC geography is actually characterized by much more variety in its range of offerings.

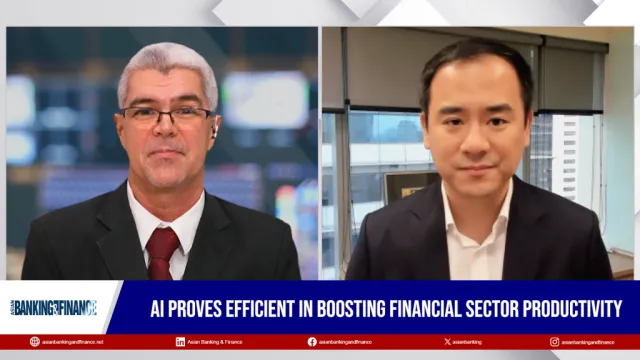

Technology takes center stage in wealth management

The shift in the wealth management landscape from a client and regulatory perspective have significant technology implications for Asian Wealth Managers. There are three key areas in Wealth Technology that is taking centre-stage; namely, an increasing focus on client-centricity, using compliance as a competitive advantage, and a relentless focus on lowering the cost to serve through platform change.

Why Europe’s problems benefit Asian banks...for now

Over the past couple of months, Europe has been at a crossroads. Ever since the fears among investors intensified in late 2010 regarding the financial stability of the southern European member countries, first and foremost Greece, European political leaders have implemented and applied a vast amount of tools to fend off the looming debt crisis. The current goal among Europe’s political elite is to prevent the debt crisis from spreading to bigger and too-big-too-bail-out economies in central and northern Europe and thereby to keep the Eurozone from breaking apart. These developments are closely watched by Europe’s economic partners, especially the US and Asia. Focusing on Asia in particular, the big question for Asian politicians, economists and market participants is now: how has or will the sovereign debt crisis in Europe affect Asia? Although the answer is everything but trivial, it is generally believed that Asia will most likely be affected in two ways: trade and finance.

Coping with sluggish bank lending in Asia

The year 2012 has not been good for the Asian banking industry. Credit growth is falling in most Asian countries. For instance, new lending by the four biggest Chinese state-owned banks was flat in April and May 2012. There are multiple reasons for this. The primary reason is the slowdown of real GDP growth in most Asian countries. Newly released macro data predict a slump in the economy in those countries. Due to the expectation of a weak economy, the demand for new credit is not as strong as in previous years. Weak exports to the Eurozone and the U.S. will likely cause damage to the manufacturing industry in export-oriented Asian countries and reduce their demand for bank loans. The slowdown in real GDP growth and trade growth predicts a likely surge in non-performing loans in the Asian banking industry.

SMEs still prefer conventional FX risk management

But bankers say that those with higher FX volumes could conduct such activity online.

How will foreign banks' local incorporation affect Singapore's banking industry?

Foreign banks are now forced to decide whether to further commit to the Singaporean market and compete with domestic banks neck-to-neck, says ADB.

Temasek in search of energy investments

Data from Temasek showed that resources and energy accounted for 6% of its portfolio as of the end of March.

Advertise

Advertise

Commentary

The Asian connection: China's path to sustainable growth