Singapore

Singapore banks' loan growth slows down after blistering 1Q13

Singapore banks' loan growth slows down after blistering 1Q13

April statistics reveal momentum is moderating.

Islamic banking continues Singapore expansion

Middle East banks in Singapore now offering Islamic banking.

What JP Morgan's Jamie Dimon means for the Asian banking sector

Like or not, Jamie Dimon, JP Morgan Chase’s (NYSE: JPM) iconic Chairman & CEO, survived a referendum vote of his leadership over his bank. On May 21, the combative leader of the bank just scored a resounding victory. In what has to be considered something of a shocker, just 32.2 percent of shareholders voted in favor of the split, compared with 40 percent last year.

What Asian banks need to know about customers' trust and fair treatment (Part 2)

In Part Two of a special series of reports regarding conduct risk and consumer protection regulations, we continue with a brief history on the principles of fair treatment.

Why strong 'mind share' is important in Asian transaction banking

Asian banking success is traditionally measured by Market Share, Wallet Share and Customer Satisfaction rankings. Yet an oft-overlooked metric is ‘Mind Share’. How can banks that are operating in highly competitive and increasingly interconnected Asian markets garner greater support and advocacy of their products and services? This strategic and commonly misunderstood challenge is a clear differentiator between some of the key banks in Asia, and their competitive position against rivals. The concept also offers a valuable opportunity for growth and overall competitive positioning fulfilment.

Citi to open 6 more Asian desks for its corporate clients in the next 12 months

Find out where the desks will be located.

Creating value in Asian private equity transactions in 2013

At the risk of generalising, whilst buyout deals do exist (but are rare), most Private Equity Funds in Asia typically take minority stakes in companies (about 20%) and work with the founders to grow these companies for IPO or for trade sales. This means that in Asia, the PE Firm cannot replace the management of such companies easily and thus in Asia it usually takes more than mere capital to grow a company and prepare the target company for an exit.

Standard Chartered launches first offshore RMB issuance in Singapore

StanChart is the sole lead manager.

Singapore eager for more renminbi business

First MAS representative office in Beijing good for commercial banks.

Check out BNP Paribas' new integrated platform for its corporate clients

CENTRIC launched first in Hong Kong and Singapore.

MAS opens office in Beijing

It’s the third overseas representative office of the Monetary Authority of Singapore.

Moody's reaffirms OCBC Aa1 rating with a stable outlook

Rating reflects OCBC’s strong capital position.

ICBC Singapore to start clearing renminbi

Will start doing so for participating banks today.

Tharman reappointed MAS board chairman

He will serve until May 31, 2015.

How banks adopt to the rapid pace of technological change

Learn from Westpac, BPI, and CIMB.

Islamic banking conference to be held in Singapore

Leading industry players to meet June 3 to 5.

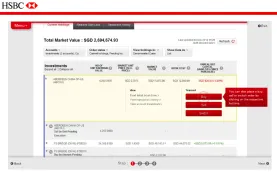

What you need to know about the new HSBC Wealth Dashboard

Cash, investment holdings displayed in real-time.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership