Singapore

It's high time to educate the new generation of retail bankers

It's high time to educate the new generation of retail bankers

The banking model is fatally flawed. It’s time to break up the universal banks, separate the cavalier commercial arm from the retail element, and educate the new generation of retail bankers.

The impact of fragmentation and complexity on AsiaPac banks

Banks across Asia Pacific continue to wrestle with issues surrounding corporate actions processing. Changes to the distribution of event notifications – often still inconsistent and fraught with delays that increase risk and operational costs – have long been overdue. However due to the fragmented nature of the Asia Pacific region, creating a standardized approach to overcome these problems is a significant challenge.

Here's all you need to know about BofAML's new CashPro Accelerate

It's now available to treasury management clients in 12 markets in Asia Pacific.

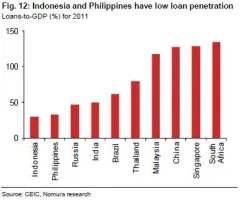

Loan penetration extremely low in ASEAN

Guess which country has the lowest loan penetration at 30% of GDP?

Check out how Citi's new 'smart-banking' machine lets you bank outside of the branch

You can start a transaction on a mobile device and complete it on Citibank Express.

Indonesia has the most profitable banking system in ASEAN: Nomura

Its ROA is forecast to reach 2.7% in 2013F.

OCBC to aggressively boost growth in Indonesia, China

It now has 350 branches in Indonesia.

OCBC Bank suffered from margin pressure

Pressure was evident in Singapore, Indonesia, and China.

2 reasons behind OCBC's weaker underlying banking trends

Margin decline is one culprit.

BNP Paribas aims to grow investment banking revenues in Asia to over 3b euros by 2016

It's a compounded annualised growth rate on the order of 12%.

BPI's profit growth predicted to slow sharply

Blame it on high base from trading gains.

Singapore banks weakest in Asia

Earnings to barely grow 2% YoY.

Here's why large Asian banks have been gaining market share

Current and savings accounts deposits increased 4.9%.

DBS' big boss asserts operating profit growth is realistic this year

But it'll be 'mid-single digit'.

This is how these large Asian banks' deposit market share has increased since 2003

Guess which bank gained the most market share with a 6% growth?

Hong Kong's large banks raked in more deposits than Singapore's

Find out how big the difference is.

Singapore banks' cost of deposits among the lowest in Asia

It stood at 0.9% vs Asia's 2.8%.

Advertise

Advertise

Commentary

Why APAC banks must rethink their approach to the cost reduction challenge

Thailand backs major conglomerates for digital banks but risks stifling innovation