Singapore to pilot use of wholesale CBCDs in 2024: Menon

MAS is also rolling out GPRNT.AI, an ESG data platform for financial institutions.

Singapore will be piloting the live issuance and use of wholesale central bank digital currencies in 2024, a top official announced.

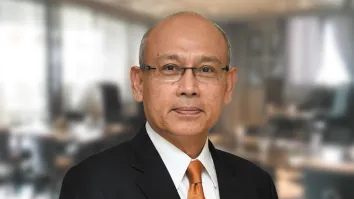

Speaking to attendees of the Singapore Fintech Festival on 16 November, MAS managing director Ravi Menon said that the Monetary Authority of Singapore (MAS) will be partnering with local banks to pilot wholesale digital money use.

During the pilot, the wholesale CBDCs will be used for domestic payments.

Banks will issue tokenized bank liabilities through the form of claims in balance sheets. Retail customers can then use the tokenised bank liabilities in transactions with merchants, who will then credit these with the participating banks.

The CBDC, in turn, will be transferred and credited automatically to the merchant during the transaction.

Digital Money

Menon reiterated his and Singapore’s stance on privately issued cryptocurrencies, saying that they have “failed the test of digital money.” He particularly noted the dramatic price swings of crypto.

Just in March, two US banks with significant exposure to cryptocurrency— Signature Bank and Silvergate Bank— experienced failures.

Similarly, he championed the use of wholesale CBDCs and tokenized bank liabilities.

“Now these can play the role of digital money and help achieve atomic settlement,” Menon said, adding that these correspond with the current financial and money system.

Project Green Print

Menon laso talked about the launch of GPRNT.AI or Green Print.

The entity, supported by MAS, banks HSBC and MUFG, as well as firms KPMG and Microsoft, aims to collate data from Singapore’s Project Guardian and also to create a platform that can provide good ESG data.

“Our goal is for Green Print to become the baseline for how companies will report ESG data,” Menon said.

He also expressed hopes that Green Print will help with the goal of achieving net zero goals by 2050.

It will go live in February 2024 and will progressively scale over the year.

Advertise

Advertise