Simon-Kucher expert says Asia’s banks overspend with blanket deposit pricing

Most institutions simply follow central bank moves, offering the same rates to broad customers.

Asia’s banks are overspending on deposits because they rely on blanket pricing strategies and reactive rate adjustments, according to an expert.

Instead of actively managing deposits, most institutions simply follow central bank moves, offering the same rates to broad customer groups regardless of behavior or sensitivity.

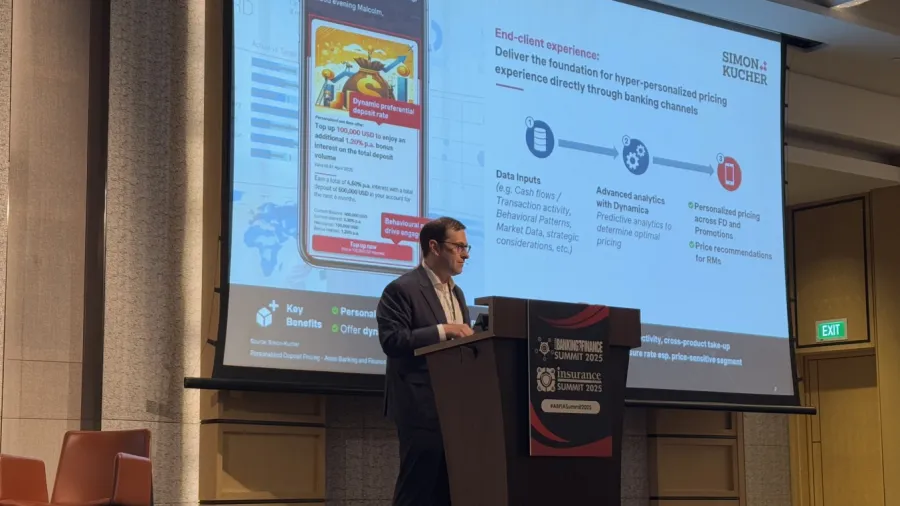

Silvio Struebi, Partner at Simon-Kucher, said at the Asian Banking & Finance and Insurance Asia Summit in Singapore that banks must replace this “one-price-fits-all” approach with data-driven, personalised deposit pricing.

By decoding customer flows and tailoring offers, banks can both reduce funding costs and attract stable deposits.

Traditional deposit pricing is blunt. Banks set one rate for retail, one for affluent, one for SMEs—and call it a day.

According to Struebi, this wastes resources and misses opportunities.

“One price fits none. Some customers feel maybe too expensive, or others [feel] it is too cheap. You overspend. And this is what we want to address,” he said.

Analysing transaction flows allows banks to tailor rates to segments or individuals. Targeted offers, like delivered via e-banking or email, encourage clients to stay loyal whilst containing funding costs.

Struebi described analysing millions of behaviours, from salary credits to FD rollovers, and combining them with competitor data.

“We clustered them, and we estimate the elasticity models… how would this flow change when rates change within the bank or externally, when the competitors are changing,” he said.

This modeling lets banks act before customers move their funds. Targeted campaigns at renewal points or tiered loyalty offers can prevent leakage.

On average, Struebi noted, banks achieve 8 to 18 basis points of improvement.

Once mastered in deposits, personalised pricing can be scaled to other areas.

“Quite often, once we start with deposits, there’s then also a need to move to other product categories, because we can also do it for loans. We can do it for investment products. FX is very interesting as well,” Struebi said.

But he cautioned that banks’ bigger challenge is internal.

Years of “erratic promotions” have taught customers to be overly price sensitive, cannibalising value across products.

A more consistent, scientific approach, backed by AI tools and model governance, can restore disc

pline whilst keeping customers engaged.

“Dynamic and personalised pricing is really getting traction right now. Banks are simply overspending,”

For banks seeking both cost efficiency and growth, the message is clear: stop reacting to market shifts, start pricing deposits smartly.

Advertise

Advertise