Singapore’s big three banks averaged 3% decline in total returns in Jan-May: SGX

They are performing better than their US counterparts, however.

Singapore’s big three banks averaged 32% total returns since the end of 2019, although they reported a decline in returns in 2023, according to a market update released by the Singapore Exchange (SGX).

For the period beetween January to 12 May 2023, DBS, OCBC, and UOB averaged a 3% decline in total returns, a slight reversal from the 13.1% average total returns in 2022.

Notably, the three banks’ averaged a 2.2% decline in total return between the 8 March to 12 May period. This is “significantly more defensive” than the 8% decline for the Dow Jones US Large Cap Banks Index, noted the SGX.

Despite the current decline, the three banks’ 10-year annualised total return was 7.5% as of 12 May.

The decline is in contrast to the three banks reporting record quarterly profits for Q1, supported by growth in their net interest incomes.

At S$11.7b, the combined total income of the three banks’ is up 36% compared to the first three months of 2022. It is also 8% higher than in Q4 2022.

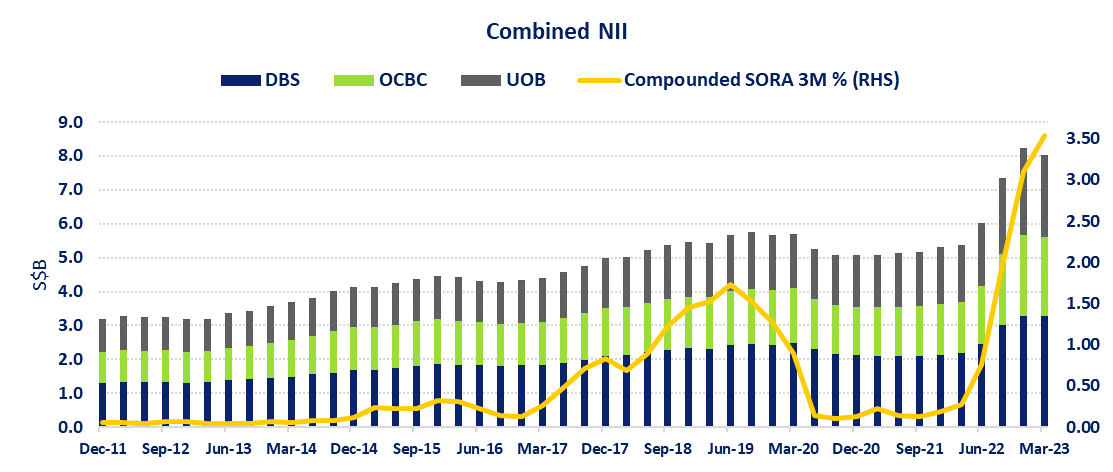

Combined net interest income is at S$8b, up from just S$5.4b in Q1 2022, but lower than the S$8.2b recorded in Q4 2022, although SGX noted that this was more due to Q1 2023 being a shorter quarter compared to Q4 2022.

With this, OCBC, UOB, and DBS have reported nine consecutive quarters of combined quarter-on-quarter net interest income growth.

Net interest margins of the three banks also rose thanks to higher global interest rates: DBS expects NIM for the whole year to be between 2.05% to 2.1%; OCBC maintained its NIM target of 2.2%; whilst UOB’s business update foresaw “its margins to hold up, at current levels,” SGX noted.

The trio of UOB, OCBC, and DBS also maintain their Return on Common Equity ratios above the median ROE for the top quartile of global banks by market value, SGX said. UOB maintained a 14.9% core ROE; OCBC’s ROE is at 14.7%; whilst DBS highlighted a record-high ROE of 18.6% for Q1.

Advertise

Advertise