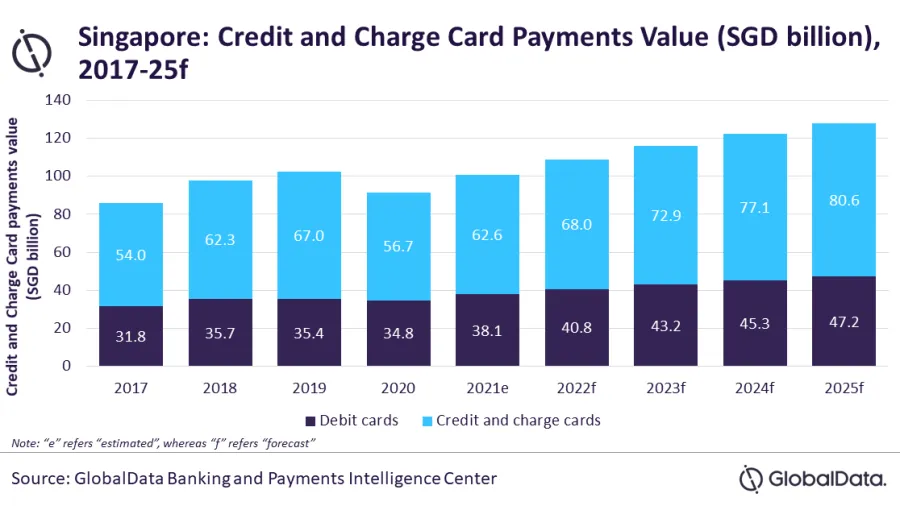

Singapore’s credit, charge card payment market to grow 6.5% through 2025

The value of debit card payments will grow by 7.2% in 2022.

Singapore’s credit and charge card payment market will grow at a compound annual growth rate of 6.5% between 2021 and 2025 to reach S$80.6b (US$59.8b) in 2025, according to data and analytics company Global Data.

The market is forecasted to grow at 8.8% in 2022, whilst the debit card payment value will grow at 7.2%, on the back of the Lion City’s GDP recovering.

Singapore’s economy registered a 7.2% growth in 2021, reversing its 5.4% contraction in 2020. The value of credit and charge card payments in Singapore registered a decline of 15.3% in 2020.

READ MORE: SMEs embrace flexible payments as consumers seek digital options

Singapore’s strong card acceptance network–at almost six point of sale (POS) terminals for every 100 individuals in 2021–also pushes up the use of credit and charge card payments.

Banks’ offering of flexible payment options and installments will further encourage its use, according to GlobalData.

Advertise

Advertise