News

UOB adopts the Equator Principles to refine sustainability strategy

UOB adopts the Equator Principles to refine sustainability strategy

The bank will apply the principles to assess and manage environmental and social risk projects.

Deutsche Bank names APAC head of wealth solutions

Dominique Jooris was CEO of Bank Pictet & Sie in Singapore prior to his new role.

Bank of East Asia profit rebounds nearly 75% to $2.67b in H1

This increased from $1.53m in the same period last year.

Philippine lender SB Finance teams up with FinScore to enhance credit scoring power

SB Finance said it will use FinScore’s solution to predict the creditworthiness of borrowers.

Citi TTS APAC client inquiry for API use doubles in H1

They have processed close to 350 million API calls for corporate clients since 2017.

Chinese banks’ posed for e-payment scene comeback with digital renminbi’s launch

The e-CNY will support growth of banks’ e-payment customer base and improve overall financial stability.

Hong Kong’s ZA Bank launch new credit card repayment feature

Users can pay their credit card bills issued by any bank through ZA Bank, for a period of up to 72 months.

Philippine bank ratings at risk of another downgrade: Fitch Ratings

Fitch ratings downgrades the Philippines’ banking system operating environment score to negative.

Security Bank posts net profit of $61.35m in H1

Net interest income and non-interest income both fell compared to H1 2020.

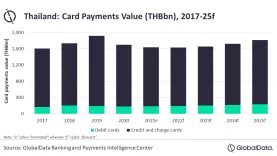

Chart of the Week: Thai card payments market to shrink 3.5% in 2021

Recovery is not expected to begin until end-2022, says GlobalData.

Hong Kong neobank ZA Bank launches early payday product

Users can get their monthly payroll up to seven days in advance, interest-free.

New Zealand’s expected interest rate hike to raise banks’ profits: Fitch

However, its impact on earnings may take some time to rise as mortgages are not yet due.

Citi named top international IPO bank in APAC ex Japan

The bank said that it has raised over $30b from IPOs for its Asian clients.

Check out the winners of the ABF Corporate and Investment Banking Awards 2021

Over 40 banks and financial institutions were awarded in this year’s programme.

Mizuho, IFC inks MOU to establish carbon facility

It will facilitate the purchase and sale of voluntary carbon credits.

Bank of East Asia unveils UnionPay QR code cash withdrawal service

All BEA ATMs in Hong Kong will offer this service.

Vietnamese neobank Timo partners with Mambu to offer cloud-core banking services

Vietnam’s banking industry is ripe for disruption with low financial inclusion but high smartphone ownership.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership