News

Singapore banks' NIMs to degrade after US Fed surprise rate cut

Singapore banks' NIMs to degrade after US Fed surprise rate cut

DBS and UOB guided declines of 5-7bps.

Financial inclusion needs to be more than just about technology

Products need to be sustainable and scalable to meet the needs of the unbanked.

Malaysia's latest OPR cut needed to cushion COVID blow

The central bank slashed OPR to 2.5% amidst the virus’ global and domestic impacts.

Big three banks' wealth income expanded 18% in FY2019

Wealth made up 31% of OCBC and UOB’s total income.

Bank of East Asia to review its portfolio

Profits were nearly halved in Q4 2019 due to impairment losses from mainland China.

Weekly Global News Wrap: Goldman Sachs asks clients to skip New York meet; StanChart 2019 profits up 46%

And Italy’s Intesa Sanpaolo hires global banks as advisers in suprise takeover bid.

Taiwan's central bank to stabilise forex after US rate cut: report

The US made its first emergency cut since 2009 as COVID-19 continues to spread.

COVID-19 to hit banks in ASEAN's tourism-reliant countries

Local lenders in Singapore and Thailand are at most risk.

India's shadow banks hit with $15.1b in debt repayments

Meeting the deadlines will be a challenge given the domestic funding crunch.

World Bank launches $12b COVID-19 package for developing countries

It aims to strengthen countries’ health services and support the private sector.

Huge returns boost foreign banks' investment in India

Foreign annualised ROEs grew 9.9% in the six months until end-September.

Solvency improvements threaten Vietnamese banks' strong 2019 performance

The State Bank of Vietnam is expected to allow Basel II banks to grow loans faster.

MUFG-Morgan Stanley joint securities arm axes equities staff

Two managers and few research analysts were let go as a cost-cutting move.

China lets banks waive bad loans from COVID-hit firms

Qualified businesses can apply for delays until end-Q2.

Singapore banks face slower loan growth in H1 2020

The big three banks’ are expecting lower loan growth for FY20F on the back of the outbreak.

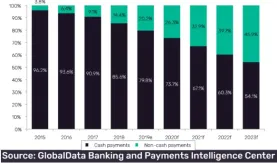

India's share of cash payments will lower to 54.1% by 2023

The government has waived merchant fees on payments through RuPay.

StanChart's earnings recovery to be delayed by COVID-19: S&P

The group’s target 10% RoTE will likely be delayed beyond 2021.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership