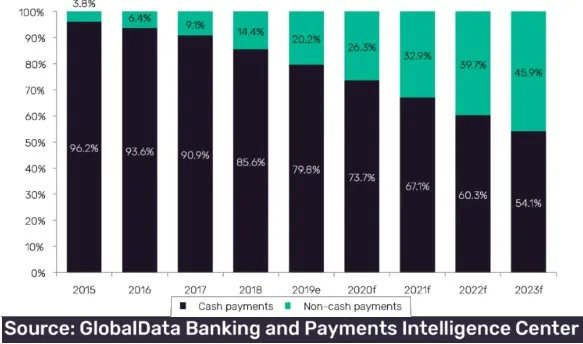

India's share of cash payments will lower to 54.1% by 2023

The government has waived merchant fees on payments through RuPay.

India is stepping up efforts to reduce its cash dependence, with share in total payments volume seen to decline from 79.8% in 2019 to 54.1% in 2023, according to a GlobalData report.

To accelerate this trend, the government has completely waived merchant fees in payments through state-backed RuPay debit cards, as well as the Unified Payment Interface (UPI) instant payment system, starting 1 January.

India has also required that all businesses with an annual turnover of US$7.2m (INR500m) should allow payments through RuPay and UPI QR codes.

In addition, mobile payments solutions like Paytm, Google Pay, and PhonePe are gradually replacing cash for low-value transactions, becoming widespread in supermarkets, groceries, street vendors, tea stalls, and fuel stations.

Advertise

Advertise