Agent Banking's impact on financial inclusion in Bangladesh

By Md. Touhidul Alam KhanAgent banking has a transformative role in bridging the financial inclusion gap in Bangladesh.

Bangladesh's financial inclusion narrative has undergone a seismic shift, evidenced by the substantial disparity between rural and urban deposit accounts. This article explores the transformative role of agent banking in bridging the financial inclusion gap and its socio-economic implications.

Agent Banking:

Agent banking, a catalyst for change introduced formally in 2013, has seen 31 banks spearhead this initiative, reaching union levels and providing financial services to rural and underprivileged individuals. This innovative approach encourages participation, especially among women.

Statistical Overview:

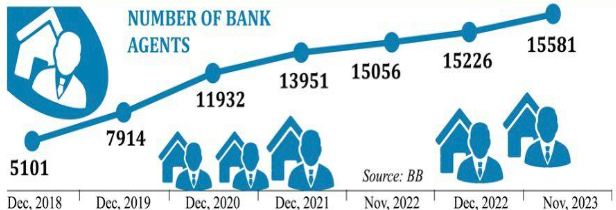

As of November 2023, Bangladesh boasts 15,581 agents and 21,506 outlets, with rural agents surpassing urban counterparts. The cumulative number of accounts reached 21.20 million, with a deposit balance of Tk 351.69 billion. Notably, remittance inflow through agent banking reached Tk 21.24 billion in November, showcasing its crucial role in facilitating cross-border financial transactions.

Loan Disbursement Dynamics:

Bangladesh Bank data highlights a significant urban-rural divide in outstanding loans, disbursement, and recovery. With the outstanding balance in November at Tk. 83.87 billion, disbursement in rural areas is more than twice that in urban areas. Agent banking efficiently caters to the unique financial needs of the economically disadvantaged, particularly in microcredit loans.

Sector-wise Analysis:

Private banks lead in the number of agents and outlets, holding 70% of total agents, followed by Islamic banks with 25%, and state-owned banks with 5%. In terms of outlets, private commercial banks dominate with 77%, Islamic banks with 19%, and state-owned banks with 4%.

Financial Impact and Future Prospects:

Agent banking has positively impacted deposit collection, remittance inflow, and loan disbursement, particularly in rural areas. Its growth over the past decade underscores its potential to transform the economic landscape for underserved communities, aligning with the need for cost-effective approaches in providing accessible and secure formal financing for agriculture and rural SMEs.

The Role of Agents:

The agent banking model ensures real-time banking for customers, equivalent to services at the main branch. Biometric devices enhance security, mandating fingerprint verification for transactions. Eligible agents include NGOs, cooperative societies, postal offices, mobile network operators, and other entities approved by the Bangladesh Bank.

Conclusion:

Agent banking stands as a pivotal solution for extending financial services to the unbanked and under-banked population in Bangladesh. This paper highlights significant strides, emphasizing the need for continued collaboration between banks and regulatory authorities to sustain and expand the success of agent banking. The unique approach of agent banking holds promise in fostering economic growth and development in underserved communities, serving as a beacon of financial inclusion in Bangladesh's evolving landscape.

Md. Touhidul Alam Khan is the managing director and chief executive officer of National Bank Limited, Bangladesh.

Advertise

Advertise