OCBC beats DBS, UOB with 44% of its NPLs not overdue

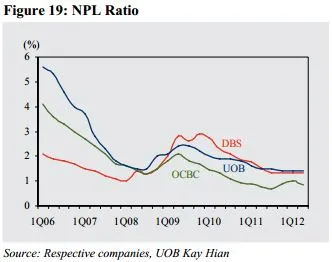

OCBC has the lowest NPL ratio at 0.9% compared with 1.3% for DBS and 1.4% for UOB.

According to UOB Kayhian, a cursory look at indicators such as NPL ratio and loan loss coverage reveals a mixed picture for the asset quality of Singapore banks. OCBC has the lowest NPL ratio at 0.9% compared with 1.3% for DBS and 1.4% for UOB. However, OCBC also has the lowest loan loss coverage at 125.4% compared with 129.2% for DBS and 136.6% for UOB.

Here's more from UOB Kayhian:

OCBC has caught up. Complicating the picture is the fact that Singapore banks have become more conservative. Take DBS for example. It has consistently been conservative in recognising NPLs and 32.8% of its NPLs are not overdue in interest and principal.

Unknown to the market is the fact that OCBC has caught up over the past four years. Currently, 44.3% of its NPLs are not overdue in interest and principal, the highest among Singapore banks, up from 15.2% in 1Q08.

Advertise

Advertise