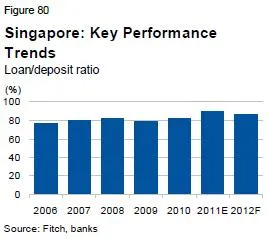

Singapore’s surging loan/deposit ratio

It increased to 90% in 2011 compared to 82% in 2010.

According to Fitch analyst Alfred Chan, the domestic deposit franchise supports funding profiles, and mitigates wholesale funding needs. The banks have relied mainly on Singapore dollar deposits to fund US dollar loan growth, with FX gaps closed via currency swaps, although this has resulted in loan/deposit ratios increasing to about 90% at end-2011 from 82% at end-2010. “Fitch believes that the tight US dollar liquidity needs to be monitored for funding risks, as the loan/deposit ratios for all three banks. US dollar books exceed 100%,” he added.

Graph from Fitch 2012 Outlook: Asia Pacific Banks

Advertise

Advertise