Huge capital gap hounds China's big banks

The gap could expand up to $943b by 2024.

China’s four major banks are facing an enormous funding gap to meet international “too big to fail” standards, estimates by S&P Global Ratings revealed, as the country is halfway through its 10-year schedule to strengthen its total loss-absorbing capacity (TLAC).

The aggregate TLAC capital shortage is estimated at $323b (CNY2.25t) at end-2019 and will increase over the next few years, S&P said, as China’s capital generation has been sluggish compared to its growing regulatory liquidity needs.

The gap could expand to $835b-$943b (CNY5.77t-6.51t) by 2024 assuming no new capital fundraising, the report added. The lenders have until 1 January 2023 to hit the standards, but the timeline could be accelerated under certain circumstances.

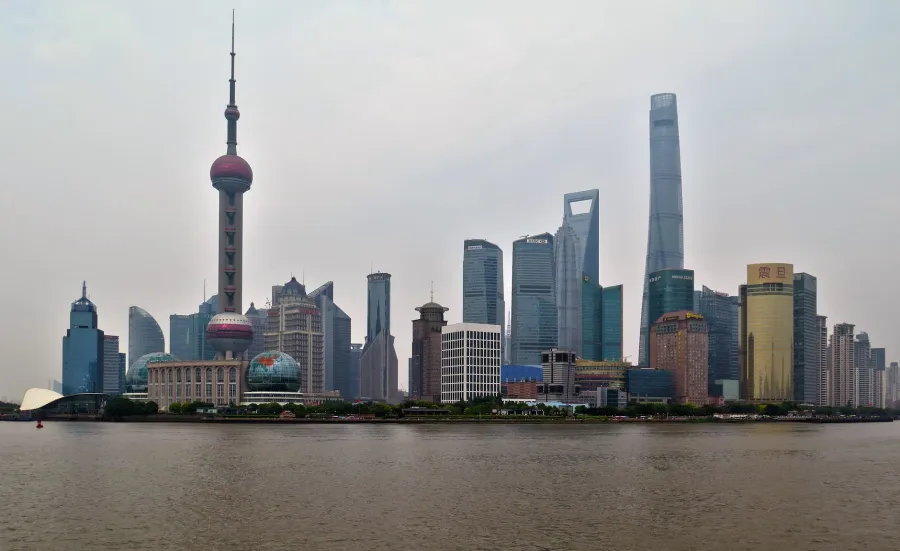

The four, namely Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Agricultural Bank of China, and Bank of China, have all been classified as globally systemically important banks (G-SIBS).

"The Big Four banks' synchronisation with global loss-absorbing standards is a key topic for investors, because it influences capital structure, the cost of funding, and importantly, the mechanism for extraordinary support," said credit analyst Michael Huang.

China, as the only emerging market with G-SIBs, has been given more time to set up the legal, regulatory, and financial infrastructure to pave the way. Regulators have so far streamlined loss-absorbing requirements on bank hybrid capital instruments, floated perpetual bonds for banks, and encouraged insurer participation of regulatory capital investments.

However, more needs to be done to bridge the TLAC funding gap, the report noted.

Advertise

Advertise