Aggregator threat closes in on open banking

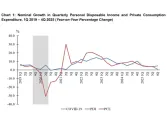

Banking customers may switch now that they can compare their bank's performance with others.

When incumbents assess the risk that comes with the increasing inclination of regulators to require open application programming interfaces (APIs), the potential of aggregators to whisk away clients ranks high as an emerging threat. In Japan, for example, new rules have been directing banks such as Mizuho Bank to use open APIs, which means having to disclose more information than ever before, providing customers with greater insights into their banks’ performance compared with other providers.

Aggregators stand to benefit from this shift, offering customers the chance to seek out their ideal financial products and the convenience to switch to other platforms, said Stanford Swinton, partner at Bain & Company.

“With open APIs, many of the long-standing barriers to switching providers will dissipate,” said Swinton. “Big banks face the prospect that many of their customers may seek out the convenience of digital aggregators, taking their accounts, and the profit pools they represent, with them. They have a reason to be concerned.”

With the high stakes at hand and the looming regulatory pressure to embrace aggregation, incumbents are starting to explore partnering with third-party digital platforms to achieve their digital goals, said Nilesh Vaidya, executive vice president at Capgemini. “With regulators across the globe pushing for API adoption, banks will eventually be forced to share data with collaborators."

Despite this, Vaidya reckoned that the financial services industry is a laggard in API adoption, adding that banks outside Europe need to be more proactive in API implantation rather than waiting for regulatory compliance to become mandatory. He said some European banks are implementing APIs to bolster “collaborative innovation” as seen in Citibank, Fidor, and BBVA developing an API marketplace to house new concepts in online banking.

Advertise

Advertise