Australian banks may issue euro bonds to meet capital requirements

They will need to raise $34.32-41.87b worth of Tier-2 capital by 2024.

The new capital requirement to be imposed on Australian banks will compel them to strengthen their Tier-2 capital ratio from 2% to 5% by January 2024, and raise $34.32-41.87b (A$50-61b) worth of Tier-2 capital by the whole year, according to a report from Natixis Research.

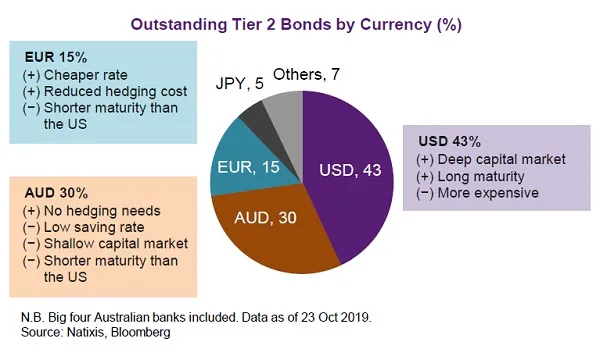

“Although domestic rates are getting lower, overseas issuance demand will surge due to the depth and funding structure. Aside from the USD, issuance in the EUR could provide an attractive alternative given the low rate environment and cheaper funding costs in the Eurozone,” the report’s authors wrote.

Also read: Australia's big banks may need to raise $12.6b to plug steep capital requirements

Currently, the currency mix in Tier 2 bonds issued by Australian banks include 43% in USD, 30% in AUD and 15% in EUR.

Due to a shallow domestic capital market, low saving rate and volatile current account balance, Australian banks needed overseas funding. They are also expected to continually issue Tier-2 bonds given high funding needs and a limited domestic bond market size.

The Australian Prudential Regulation Authority (APRA) expressed plans in August to introduce the total loss absorbing capacity (TLAC) for the four domestic systemically important banks (D-SIBs), which will require them to raise additional capital.

Advertise

Advertise