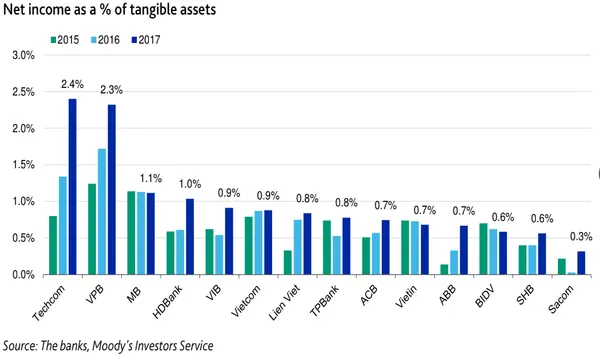

Chart of the week: Check out how Vietnam banks' profitability improved in 2017

Stable economic conditions and a robust core income segment buoyed earnings.

Vietnamese banks are registering improved profitability levels in 2017 thanks to stable macroeconomic conditions and growth in core income segments as aggregate pre-provision income at rated banks surged 40% driven by net interest income, net fees and commissions, according to Moody's Investors Service.

Higher revenue levels were also able to offset bad debt charges and mitigate the impact of credit costs on bottom-line profitability.

Here's more from Moody's:

The asset-weighted average spread between loan and deposit rates expanded to 3.9% in 2017 from 3.7% in 2016, as banks boosted retail loans. Particularly, the spread widened substantially at Vietnam Prosperity Jt. Stock Commercial Bank (VPB, B2 stable, b3), which has been the best in class in this metric due to its focus on higher-yielding retail loans

We expect banks' top-line growth to continue to be strong in 2018, supported by a robust economic environment. Also, banks' bottom-line profitability will benefit from reduced provisioning burdens owing to improved bad debt settlements, coupled with increased recoveries through the sale of seized collateral under Resolution 42.

Advertise

Advertise