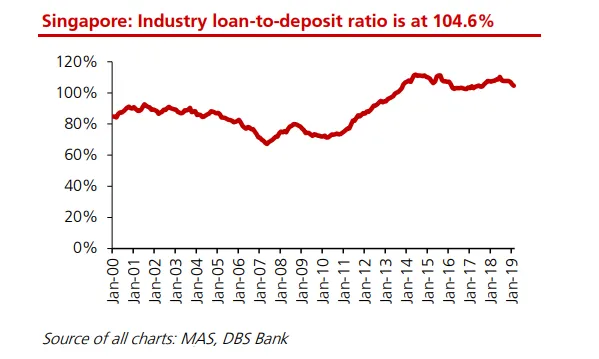

Chart of the Week: Singapore banks' LDR slows to 104.6% as lending weakens

On the other hand, deposits grew at a near-two year high at 6.3%.

The loan-to-deposit ratio of Singapore banks slowed to 104.6% in February from a peak of 109% in the previous year as deposit growth outpaced lending, according to a report from DBS.

Deposits grew at the highest rate in nearly two years with overall deposits expanding by 6.3% in February which represents the fastest pace of expansion in 23 months. This was driven by double-digit growth in fixed deposits which hit 18.9%.

On the other hand, loan growth hit just 3.3% in February amidst weakening consumer sentiment. Consumer loan growth slowed to 0.5% in February which is even lower than the 1.4% seen in May 2006 or the cycle low before the Global Financial Crisis.

Also read: Regional gains boost Singapore bank loans amidst weakening domestic demand

"In our view, it remains likely that continued increase in local deposit costs will continue into 1Q19 as we continue to observe competitive promotional deposit rates offered across both local and foreign banks during 1Q19, especially in the weeks leading up to the lunar new year, which is a common practice in previous years," said analyst Rui Wen Lim.

Advertise

Advertise