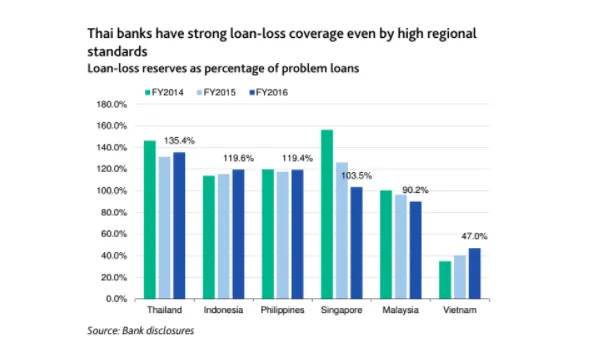

Chart of the Week: Thai banks' strong loan-loss coverage

The banks' loan-loss coverage ratio is the highest in ASEAN.

Thai banks' strong loss-absorbing buffers are a key credit strength underpinning Moody's Investors Services' stable outlook for this system, and they will further improve, thanks to healthy profitability that allows banks to generate capital internally, as well as benign credit growth.

Helped by these factors, the asset-weighted reported tangible common equity to risk weighted assets (TCE to RWA) ratio of rated Thai banks rose to 14.8% in 2016 from 14.0% in 2015, the third-highest among rated banking systems in the ASEAN region, behind Indonesia and Malaysia.

"In addition, the system's average loan-loss coverage ratio was 135% at end-2016, the highest amongst rated ASEAN banking system. Thai banks' loan-loss buffers are robust even when restructured loans are considered. Assuming 25-50% of performing restructured loans become NPLs, the loan-loss coverage ratio of rated banks would still be sufficient, at 90-107%. This is a conservative assumption, based on actual slippage rates of 20-25% at some banks over the past two to three years," added Moody's.

Advertise

Advertise