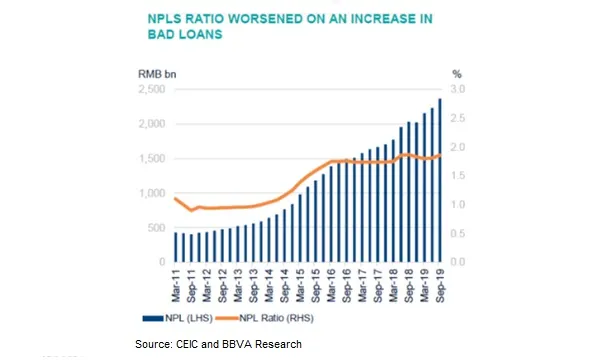

China's banks asset quality deteriorates as NPLs mount

NPL ratio climbed 3 bps compared to end-2018.

Although China’s banking sector assets growth picked up to 7.7% YoY in Q3, higher non-performing loans (NPL) caused asset quality to deteriorate especially for the country’s north-based and small banks, a report by BBVA Research revealed.

Bank assets picked up to 7.7% YoYat the end of Q3 from 6.3% in 2018,with total assets reaching $40.49t (RMB284.7t). Higher loan growth drove asset expansion amidst authorities calling for more lending to small and medium-sized companies (SMEs), with the amount of loans to SMEs growing 17% QoQ to $92.04b (RMB 647.1b).

By category, the aggregated assets of large commercial banks accounted for 39.6% of the sector’s total, representing a 3% rise from their share in 2018.

Also read: Chinese commercial banks bad loan ratio hits 10-year high in 2018

Despite this growth, asset quality deteriorated on the back of higher NPL ratio, which rose to 1.86% during the quarter from only 1.81% in Q2. This is also 3 bps higher compared to end-2018 and is almost the same level as the 1.87% NPL ratio recorded in Q3 2018.

“Rural and city commercial banks suffered a higher NPL ratio increase as the regulators have enforced a stricter standard of NPL recognition policy since last year. Troubled banks are most numerous in north China,” noted BBVA Research analysts.

But special-mention loan ratio declined to 2.99%, which if taken into account would result in banks’ overall NPL ratio dropping to 4.84% in Q3 from 4.92% at the end-2018, although still higher when compared to the 4.74% NPL+special loan ratio in Q2. .

Further weighing in is the possibility of further monetary policy easing, which will drag on the already failing interest rates of banks, the research said. The central bank has cut the required reserve ratio 4 times in 2018, followed by another 2 cuts in January and September this year.

Challenges also remain high for banks loan pricing as impairment costs remain high and deposit competition continues based on the new loan prime rate (LPR). The central bank had earlier trimmed LPR in August in a move that was projected to make borrowing costs cheaper, with the one-year LPR set at 4.25% from 4.31% previously whilst the five-year loan prime rate was established at 4.85%, slightly below the five-year benchmark of 4.9%.

Individual loan growth also continues to outpace corporate loan growth, reflecting weaker demand for credit from companies as their confidence has been affected by the ongoing trade tensions. In a more optimistic note, banks have reportedly stepped up lending to infrastructure projects and privately owned SMEs, said BBVA Research.

Banks’ net profit growth rate and net interest margin (NIM) also picked up at a modest pace as financial institutions shifted to relatively high-yield retail credit from interbank activities. Moreover, the easing envrionment1.86% contributed to overall debt cost of commercial banks to generally decline.

Also read: Will regional bank distress threaten China's fragile financial stability?

However, although NIM maintained a small increase in Q3, both the return on equity (ROE) and return on assets (ROA) continue to decline, with ROE falling to 12.57% in Q3 from 12.79% in Q2 whilst ROA dipped to 0.97% in Q3 compared to 0.98% in the previous quarter. It is related to the shrinkage of banks off-balance-sheet businesses (shadow banking), which used to contribute substantially to banks’ profit growth with no change of balance sheet size, according to the report.

Banks may also face potential capital shortfall due to a mismatch of provisions for possible loan losses and the banks’ aggressive expansions in overdue loan book for select small city and rural banks.

Advertise

Advertise