Indian state banks flounder amidst lack of leadership

The power vacuum adds to a growing list of woes plaguing the sector.

Bloomberg reports that four out of India’s 21 state banks are currently without a chief executive officer at a critical junction when the institutions badly need a leader taking charge to address the sector’s growing woes.

Also read: Indian banks forced to a halt as employees go on strike

Andhra Bank, Dena Bank and Punjab & Sind Bank have had no CEOs since the start of this year, whilst the head of IDBI Bank Ltd. was named as deputy governor of the central bank on Monday. Allahabad Bank is effectively headless as it stripped CEO Usha Ananthasubramanian of her powers after she was formally charged last month over alleged involvement in a $2b fraud at Punjab National Bank.

Bank of Baroda, Canara Bank, UCO Bank, Indian Bank, United Bank of India and Corporation Bank are amongst lenders where the incumbent’s tenure will end by March.

“These banks, devoid of CEOs, don’t have adequate capital or an appetite to lend,” said Siddharth Purohit, a Mumbai-based analyst at SMC Global Securities Ltd. “To attract the right kind of talent to these positions may be tough in the current environment.”

Also read: India's public banks hammered by massive $3.81b fraud loss in 2017-18

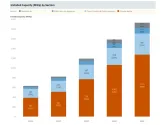

To add to their growing list of problems, Indian state banks are grappling with a staggering amount of bad loans from which not even the government's $32b recapitalisation programme can buoy them from. Little will be left for lending growth as much of the capital injection is expected to barely meet enhanced capital requirements in line with global banking rules, analysts say.

Also read: Bad debt burden delays Basel III adoption in Indian banks

The $2b scandal at state-run Punjab National Bank, often touted as the biggest fraud in the country’s banking history, also brings attention to the glaring weaknesses of India’s banking system, according to credit rating agency S&P.

“Very few steps have been taken on the reform front and follow-through on announced reforms has been weak,” S&P noted. “More concrete steps are needed to tighten banks' internal controls and risk-management practices, especially at public-sector banks.”

Here’s more from Bloomberg:

Advertise

Advertise