Indonesia banks see NPLs climb on mortgage and vehicle loan strain

CGSI said that banks should be more cautious of auto loans than mortgages.

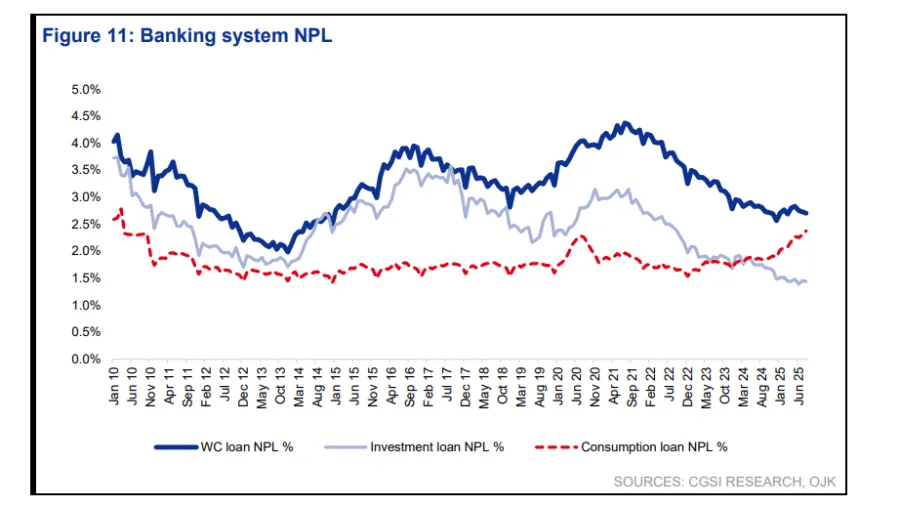

Indonesian banks’ bad loans have been creeping up since May 2023 on the back of mortgages and vehicle loans, according to CGS International (CGSI).

In contrast, working capital and investment loan non-performing loans (NPLs) have continued to trend down over the past two years, the investment house said in a December 2025 report.

“Within the consumer segment, we think the banks should be more cautious on the auto loans rather than mortgages and payroll given the concerns over a bigger car price drop compared to prior FY25,” CGSI wrote.

Major banks have showcased cautious and selectiveness in growing their consumer loan segment, CGSI observed. However, managements of these banks did indicate expectations of a potential pick-up should retail purchasing power improve in 2026, it added.

Credit risks for Indonesia’s big four banks have lessened, according to an earlier report by S&P Global Ratings.

“The banking sector's robust post-pandemic recovery and the country's sound growth prospects have reduced credit risks for banks, in our view,” S&P wrote in a press release published 9 December 2025.

However, even S&P noted pockets of stress in areas such as consumer loans and microfinance, which it said reflects a slower recovery in certain parts of Indonesia’s economy.

Advertise

Advertise