Significant gaps remain in financial accessibility, awareness: study

Over half of both unbanked and banked individuals feel that they are underserved, Mambu’s study found.

Both unbanked and banked individuals feel that they remain underserved, with over half or 56% of people with bank accounts claiming that there are other services that they should be able to access, according to a study by the banking and financial services platform Mambu.

In a survey of 2,000 global consumers, Mambu found that over 81% of banked respondents felt that their financial situation would be better if they knew more about how finances work, with 58% of unbaked consumers saying the same.

“Banks need to be looking at how they can genuinely meet the needs of these consumers. It’s not simply about whether a person holds a bank account – it’s whether they have access to the products and services that they need and want, and that they understand those services,” notes Myles Bertrand, managing director APAC, Mambu.

The influx of new technologies is rapidly changing the face of Asia’s financial services industry, especially in terms of payment facilities like e-wallets, and tech like AI, data analytics and cloud which enable greater personalisation of the customer experience, Bertrand said.

“In this age, it is vital that banks and financial institutions don’t ignore that there are still gaps when it comes to accessing and understanding financial services for consumers. Providing relevant and timely financial information to customers should be viewed as a business imperative, as should improving access to financial services for all consumers,” he added.

Personalization is going to be key for banks if they want to avoid being sidelined by new entrants that give more inclusivity and access, according to Elliot Limb, Mambu’s chief customer officer. “Banks need to be using the technology available to understand their consumers’ habits and in turn, anticipate their needs, with hyper-personalised recommendations and services,” he said.

It will also be key to driving financial inclusion, Mambu’s study suggested. The survey found that more than one in four (26%) unbanked individuals believe that financial institutions (FIs) could help them get a bank account by providing more personalised financial advisory services.

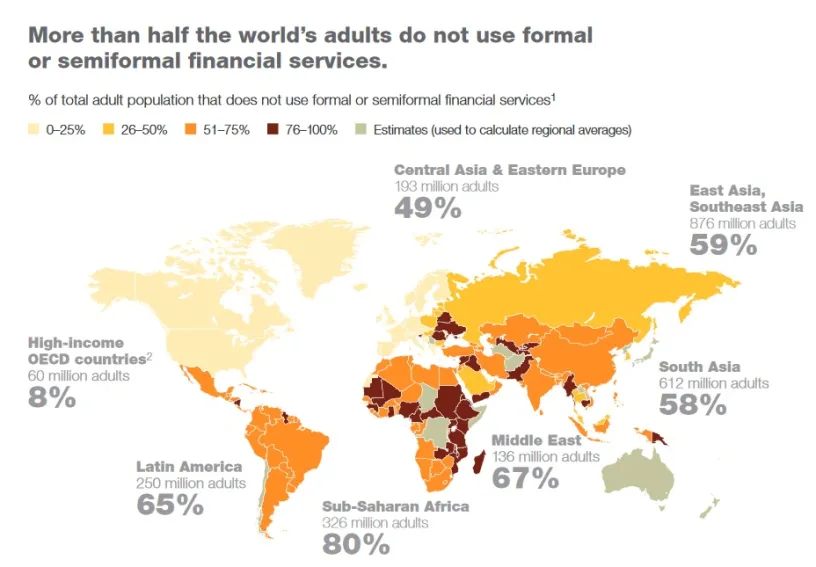

“With more than 1.7 billion unbanked adults globally, the data that’s usually reported points us to emerging markets and geographical barriers to access; however, the gap in accessibility on a global level should not be ignored,” noted Limb.

Currently, more than half of unbanked customers (65%) were less than pleased with their financial situation, whilst in the banked community, one in four (25%) are not happy with their current level of understanding about their finances and options available to them.

Boosting accessibility, understanding

Despite advances in technological services and offerings, many banked and unbanked consumers are dissatisfied with the accessibility of financial services, Mambu’s study found. In fact, majority of consumers, or 56%, believe that FIs should be responsible for educating consumers about their finances.

More than one in four (28%) of respondents stated they think banks should make it easier to understand how to open an account, whilst a further 26% of those that are unbanked believe that FIs can help them get a bank account by providing more personalised financial advisory services.

Mambu’s survey also also found that 40% of unbanked consumers stated providing more specialised and mobile and web-based services would help them become banked--highlighting the importance for digitisation amongst FIs.

Currently both the banked (57%) and unbanked (36%) respondents said that they are relying on the internet and/or online searches, not their banks, to find more financial information and to learn about their access to the right financial products, the study also revealed.

Advertise

Advertise