financial inclusion

Reserve Bank of New Zealand calls for increased efforts in financial inclusion

Reserve Bank of New Zealand calls for increased efforts in financial inclusion

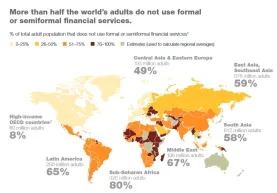

According to the World Bank, around 50,000 New Zealanders remain unbanked.

PH banks missing out on revenue from growing middle class market

Over 7 in 10 loans made by banks are extended to corporates– leaving 15 million SMEs and self-employed workers with little access to traditional finance.

How Banks Can Accelerate Financial Inclusion in Southeast Asia

Thanks to the pandemic, the uncertainty of the world economy has been especially devastating for those living on the poverty threshold and struggling to make ends meet. Many in this demographic lost much-needed jobs as the economy shrunk, while others hustled on the side, for example, as food sellers, to continue to put bread on the table.

Journey towards financial inclusion in Bangladesh

Bangladesh has established its position as a pioneering country to have made significant strides towards financial inclusion and its vision ‘Digital Bangladesh’. The country’s recent development in its financial sector, varied heritage in credit and microfinance, widespread adoption of digital finance and mobile financial services (MFS) are recognized at a global level. The government’s effort to consider financial services as drivers of shared prosperity and inclusive growth. Access to financial services and their usage have significantly positive impacts on the socioeconomic outcomes that are perceived by businesses and households. Moreover, this access and usage are considered as essential factors to poverty eradication.

Significant gaps remain in financial accessibility, awareness: study

Over half of both unbanked and banked individuals feel that they are underserved, Mambu’s study found.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership