Singapore bank earnings up 25% in 9MFY18

Return on equity hit a ten-year high.

Singapore's three largest banks continued to enjoy enhanced profitability after averaging 25% in net profit growth during the first nine months of 2018, according to a statement from the Singapore Exchange (SGX).

Also read: Singapore banks fare better than Indonesian lenders amidst rate hikes

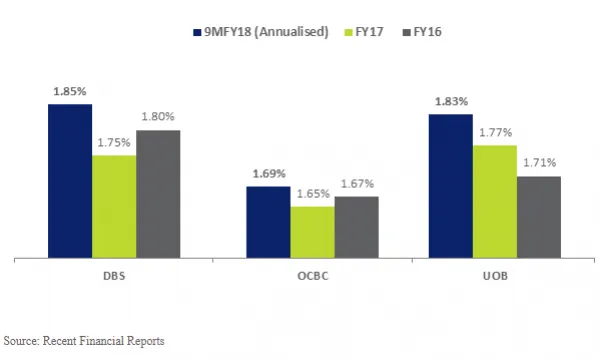

Net interest margin (NIM), a common measure of profitability, rose by an average of 8bps from 1.71% in 9MFY17 to 1.79%.

The three banks' total income also extended its steep climb at $17.64b (S$24.19b) on the back of double-digit growth in combined wealth management fees & income which grew 15% to $1.49b (S$2.05b).

Also read: DBS downplays trade jitters as Q3 results shine

"Combined, the quarterly net interest income for the three banks has gradually grown in recent years and has been consistently above S$4.0 billion ($2.92b) for each quarter since the end of 2014. This has coincided with gradual increases of local interest rates as represented by the 1-month Swap Offer Rate (“SOR”) and 3-month Singapore Interbank Offered Rate (“SIBOR“)," the bourse said in a statement.

The average Return on Equity for the three banks rose from 10.2% to a decade-high of 12.1% in 9MFY18 with DBS once again leading the pack with an ROE of 12.4%.

Advertise

Advertise