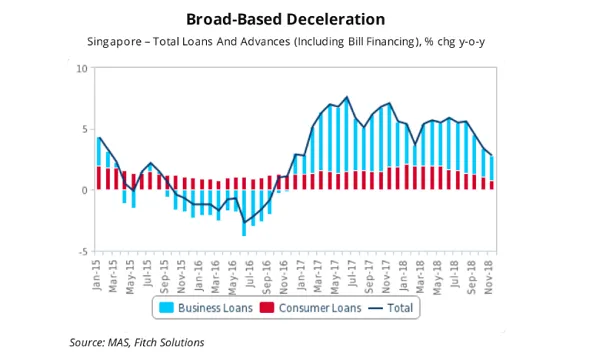

Singapore banks' loan growth to grind to a halt at 0.5% by end-2019

Mortgage loans and business-related loans are caving under pressure.

Singapore bank loans are expected to grow by a measly 0.5% by the end of 2019 from a previous estimate of 3% as the slowing housing market and decelerating Chinese economy takes its heavy toll on the commercial banking sector, according to Fitch Solutions.

Also read: Property curbs and trade war are double whammy for Singapore banks

Total loans and advances already slowed to 2.8% in November 2018 from 3.4% the previous month to record its weakest pace since the end of 2016, data from the Monetary Authority of Singapore (MAS) show.

The loan decline is set to extend as Singapore banks’ profitable mortgage businesses take a hit from the government’s cooling measures that were announced in July 2018, Housing and bridging loans, which account for 30.4% of the banks’ total loan portfolio, slowed to 2.4% in November from 4.2% in June.

“We expect the downtrend to continue as the outlook for the housing market in 2019 is likely to be weak as home buyers choose to hold back on purchases not only due to tighter restrictions, but also owing to higher borrowing costs and negative economic and property sentiment,” Fitch Solutions said in a report.

Also read: Singapore mortgage loans to grow 3% in 2019

Business-related lending is also set to cool as China’s economy decelerates under the pressure of its deleveraging campaign and protracted trade dispute with the US. In fact, loans to business already slowed to 3.3% growth in November 2018 from 8.8% in November 2017.

“[T]he expansion of Singapore’s big three banks into Greater China over the past couple of years directly exposes them to headwinds faced by the Chinese economy,” the research firm said. “This suggests that the three Singapore banks’s loan growth in China is likely to face a tougher environment in 2019 than during the deceleration in 2015-2016 when the Chinese consumer sector was not under as much pressure and the overall slowdown was not as broad as it is currently.”

DBS has the highest loan exposure to Greater China amongst the Big 3 at 31% as of September 2018, according to estimates from FItch Solutions. OCBC and UOB have loan exposure of 26% and 15% respectively.

Advertise

Advertise