Staff Reporter

Bank of East Asia to open select HK branches seven days a week

Bank of East Asia to open select HK branches seven days a week

Cash transactions will not be available during the weekends.

SG investment firm Whampoa Group to build digital bank in Bahrain

It aims to establish a digital bank by the end of this year.

MAS, New York Fed unveil results of study on DLT use for cross-border wholesale payments

Distributed ledger could be used to enhance cross-border multi-currency payments, the study found.

Fubon Bank, blockchain firm Ripple to explore real estate asset tokenisation in Hong Kong

They are aiming to make release of equity swifter and more efficient.

Hang Seng Bank, Visa to test CBDC use cases in Hong Kong

The three will collaborate to explore the feasibility of tokenised deposits.

Filipino Q1 credit card spending jumps nearly half from previous year

This was the highest recorded amount since the start of the COVID-19 pandemic in 2020.

Visa taps seven APAC startups for digital payments innovation

Startup companies were chosen from India, Mainland China, Thailand, Singapore, and Germany.

Only 30% of Singaporeans trust financial institutions, amongst the lowest in the region

In Hong Kong, Australia, and Singapore, less than half of the customers express trust in their banks.

Standard Chartered-FIS’ Worldpay to boost Straight2Bank Pay reach

This hopes to ramp up the bank’s functionalities to cater for businesses in Asia and other markets.

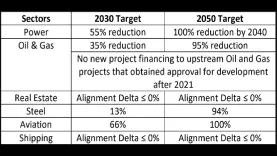

OCBC unveils decarbonization targets for six sectors

The bank commits to achieving a net zero status for its financed emissions by 2050.

Public Bank launches cross-border QR payments to Singapore

Merchants and individuals can exchange payments to and from either country.

Southeast Asia's cash in circulation to rise by 11.1% by 2027

Singapore is less cash-reliant compared to other markets in the region.

Citi Indonesia’s net income climbs 52% to $38.29m in Q1

Its Institutional Clients Group registered a 2.5% loan growth during the quarter.

Weekly Global News Wrap: Credit Suisse faces lending restrictions; Italy seeks stalemate over e-payment cost reduction talks

And JPMorgan Chase unlikely to buy another struggling bank, says CEO Jamie Dimon.

Citibank Korea doubles net income in Q1

The net income of KRW84.9b for Jan-March 2023 is 112% higher than a year ago.

Kakao Pay beset with 2 hour service disruption

This was subsequent to its the messaging app’s recent cyber disruption.

AlTi completes acquisition of SG-based AL Wealth Partners

This is in line with AlTi’s goal to assist SG’s growing clientele.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership