Frances Gagua

Standard Chartered names ex-Credit Suisse banker as new sustainability strategy head

Standard Chartered names ex-Credit Suisse banker as new sustainability strategy head

Barsky was previously global head of sustainable finance at Credit Suisse.

HKMA, local bank association launch charter to prevent credit card scams

The industry is directed not to send SMS with embedded hyperlinks.

Thailand’s KTC, Ant Group launch Alipay+ services in Thailand

Tourists can now pay using AlipayHK, Touch ‘n Go eWallet, and Kakao Pay.

MAS kicks off public consultation for code of conduct of ESG ratings, data products

The proposed code will establish minimum industry standards of transparency in methodologies and data sources.

End of cheap money era: Maybank’s Alvin Lee on investing in an era of wealth preservation, protectionism

Globalization is no longer the best strategy for banks if they wish to thrive in the new era of investing.

Alipay+ payments now accepted across 2,400 7-Eleven Malaysia stores

Users of AlipayHK, GCash, Kakao Pay, and TrueMoney can now use their mobile wallets in these stores.

Vietnam’s HDBank sets up Korea desk

It will provide Korean corporates with specialized banking products and services.

SBI Holdings now own 53.74% stake in SBI Shinsei Bank: report

Shinsei is preparing to delist and return $2.43b in public funds.

South Korean outlines new measures to improve FI's internal controls

Financial companies must clearly designated internal control responsibilities of each exec.

MUFG buying 80.6% shares in Indonesia’s PT Mandala Multifinance Tbk for $468m

MUFG will hold 70.6% of shares whilst PT Adira Dinamika Multi Finance Tbk will hold 10%.

Rising costs weight on KB Kookmin Cards’s profitability: Moody’s

Cash flow and liquidity are weak, but credit profile will remain resilient over the next 12-18 months.

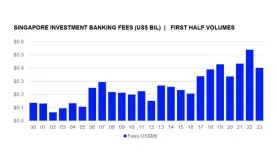

Singapore’s investment banking fees 25% lower in H1 2023

BofA Securities currently leads investment banks in terms of fees generated.

It’s time to rethink loans

It should be about offering options and putting control back in the hands of consumers so that they can decide what is best for them, says GXS' Jenn Ong.

OCBC unveils digital account opening for foreigners moving to SG

Individuals from Malaysia, Indonesia, mainland China, and Hong Kong can avail of the service.

Clifford Capital Holdings names J.P. Morgan banker as new CEO

P. Murlidhar Maiya was CEO of the bank’s South and Southeast Asia businesses.

Ripple clinches in-principle regulatory approval to offer digital payment tokens in Singapore

Majority of its on-demand liquidity transactions flow from Singapore, the company said.

MAS completes investigation on Citadelle; no further action taken

Citadelle did not breach the Trust Companies Act, according to MAS.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership