Frances Gagua

Weekly Global News Wrap: Goldman Sachs promotes 80 bankers to partners; Citi to buy Deutsche Bank's Mexican license

Weekly Global News Wrap: Goldman Sachs promotes 80 bankers to partners; Citi to buy Deutsche Bank's Mexican license

And Sweden's central bank encourages banks to moderate dividends.

MAS grants Atome in-principle approval to be a Major Payment Institution

Atome can now perform regulated payment services in Singapore.

RBC Wealth Management names Kamran Azim as COO for Asia wealth business

He will be based in Singapore.

Dah Sing Bank reopens Tuen Mun Branch

It was temporarily closed for cleaning and disinfection.

Interest rates will be Singapore banks’ boon and bane through 2023: analyst

It’ll benefit them over the next three quarters, but asset quality may deteriorate after.

ZA Bank launches tax loan with early repayment handling fee waiver

Users may avail of a 10% interest rate discount when applying for the loan before 30 November.

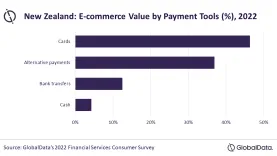

Alternative payments inch closer to e-commerce domination in New Zealand

The growth of BNPL has pushed up adoption of alternative payments.

American Express appoints Marlin Brown as Singapore Country Manager

He was recently the country manager for Thailand.

American Express has named Marlin Brown as its new Singapore Country Manager.

Dah Sing Bank’s Tuen Mun Branch closed until further notice

Staff will be tested before they return to work.

ANEXT Bank unveils programme to improve embedded finance for SMEs

The programme is open to all e-commerce marketplaces, fintechs, amongst others.

DBS, partners grant S$250,000 for climate-focused hybrid accelerator programme

The second run of Sustaintech Xcelerator will focus on nature-based approaches, amongst others.

MAS launches Ubin+ to study cross-border FX settlement using CBDCs

It will study business models and create policy guidelines.

Tokenised assets, stable coins central to Singapore’s crypto hub ambitions

Collaboration is key to achieving finance goals, says MAS’ Ravi Menon.

Singapore launches digital banker’s guarantee, insurance bond

The eGuarantee@Gov is available from over 20 financial institutions locally.

Singapore to eliminate all corporate cheques by 2025

Use of cheques for payments has declined to just 7%, says DPM Wong.

Bank of China HK joins pilot programme to trial use of digital currencies

BOCHK has completed real-value cross border trade of central bank digital currencies.

The new brand of personalisation that’s shaping Citi’s digital banking journey

Customers want options, but curate it–don’t just offer it, says Citibank’s Nilesh Kumar.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership