buy now pay later

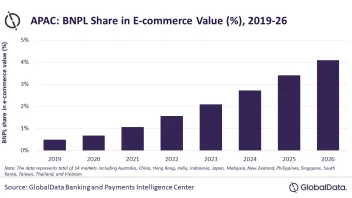

Buy now, pay later gains traction in Asia

Buy now, pay later gains traction in Asia

BNPL brand Afterpay served 20 million customers in Australia alone.

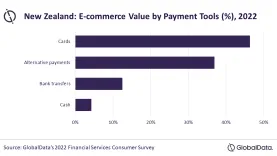

Alternative payments inch closer to e-commerce domination in New Zealand

The growth of BNPL has pushed up adoption of alternative payments.

BNPL code launched, outstanding payments limited to S$2,000 without credit assessment

Consumers are now entitled to make full repayment without early repayment fees.

Buy Now, Pay Later firms' credit losses on the rise

The largest BNPL providers have doubled their delinquency rates over the past few quarters.

Boom or bust? Buy now pay later flourishes but with default risks rising

Rising rates and tightening policies hurt borrowers’ repayment capacities and push up operating costs.

PayMongo, Atome offers BNPL services to 10,000 Philippine merchants

This comes as the share of cash payments is expected to fall further by 2025.

Chart of the Week: Buy Now Pay Later gains traction in Australia

Afterpay remains king, whilst new players seek to carve out their own space.

Here’s how you build a successful Buy Now Pay Later platform: study

Hiring the right talent and developing a good tech stack are key to success.

Fintech Pace launches BNPL payment card in Singapore

Consumers can use the card for online purchases with Pace merchants.

One in three Singaporean consumers turn to BNPL to manage money: study

But consumers’ aversion to debt pulls back wider adoption, RFI Global found.

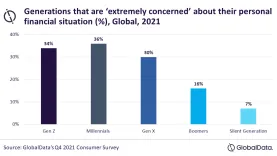

Travel-seeking Millennials, Gen Z could boost buy now, pay later: study

BNPL services could even inspire a lifetime of loyalty, according to GlobalData.

Hong Kong’s livi bank doubles customer base to 200,000 by end-2021

Its buy now, pay later service has received over 60,000 applications.

UOB’s Indonesian digital bank arm launches buy now pay later services

TMRW Pay offers deferred payments with zero-interest for up to 90 days.

Buy now, pay later gains traction in India

Low credit penetration makes it favourable for BNPL.

Buy now, pay later more needed in markets with credit under penetration: UOB TMRW exec

It’s not as urgent as other markets with credit under-penetration, says TMRW Digital Group CCO.

How Hong Kong’s livi bank aims to make banking more rewarding

They are amongst the first bank in the city to roll-out buy now, pay later services.

Standard Chartered partners with Kredivo to offer BNPL in Indonesia

Assets of fintech players in the country grew by more than IDR1t or by over $70m.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership