Cross-border payments

Cross-border B2B payments to reach 18.3 billion in 2030

Cross-border B2B payments to reach 18.3 billion in 2030

Stablecoins unlock massive potential but need significant infrastructure to be built.

RBI proposes extra authentication for first-time online card use

Card issuers are mandated to validate the additional factor authentication.

Cross-border shopping, e-wallets to shape Philippine payments in 2025

Evolving security frameworks will also redefine the payments experience, says Visa.

HSBC Singapore offers zero-fee international transfers to over 60 currencies

Amongst markets covered are Malaysia, Indonesia, South Korea, and the UAE.

Cross-border payments grow with tech and regulatory support

E-commerce, real-time networks, and digital standards drive payment volume expansion

90% of cross-border payments reach banks within an hour

But transparency remains a challenge for cross-border payment systems.

Fintechs drive instant, low-cost cross-border payment solutions

Direct access to local payment schemes expected in 2025.

Correspondent banks raise costs in cross-border payments

Inefficiencies in cost, speed, and data standards hinder global payment processes.

Cross-border payments face complexity in African markets

Regulatory hurdles and currency challenges are slowing payment settlement.

BNY partners with Mizuho to boost trade

It seeks to reduce the complexities and costs associated with cross-border transactions.

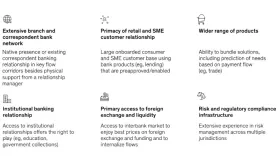

How Asian banks can retain their cross-border dominance

The emergence of fintechs is whittling down their dominance.

SWIFT rolls out pre-payment prediction service for cross-border payments

It identifies possible problems in the future payment based on previous data from 9 billion transactions.

Regulation, late digitisation challenge Web 3.0 adoption in wholesale banking

Web 3.0 is taking over, but many businesses have yet to move past Web 1.5.

MAS, France complete wholesale cross-border payment experiment using CBDC

It simulated cross-border transactions involving multiple CBDCs on a common network.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026