Digital banking

Singapore's virtual bank account ownership to soar 30% by 2026

Singapore's virtual bank account ownership to soar 30% by 2026

The figure is equivalent to 1,510,495 adults in Singapore.

Weekly Global News Wrap: JPMorgan launches Chase in UK; Credit Suisse Asia mulls merging investment and advisory arms

And JPMorgan has bought the college planning platform, Frank.

Financial institutions face four emerging challenges as digitisation ramps up

FIs role as the middleman is under threat as tech firms mull offering financial services.

Accelerate the digital banking evolution and move ahead of the curve

The roadmap to success for many organizations has been defined by digital transformation. However, since the Covid-19 crisis started, organizations across many industries had to accelerate and redefine their plans to keep pace with the dramatic changes in the business landscape.

Hong Kong’s ZA Bank hits 400,000 users

This is equal to 5% of the city’s total population.

SMEs mull switch to fintechs, digital banks as main finance service provider

More than one in three APAC SMEs consider switching to fintech.

Vietnamese neobank Timo partners with Mambu to offer cloud-core banking services

Vietnam’s banking industry is ripe for disruption with low financial inclusion but high smartphone ownership.

Meeting the challenges of SME Banking during the COVID-19 pandemic

Understanding the needs of SMEs is key to a bank’s sustainability—and even success—during the current crisis.

Virtual banking trumps branch banking in Southeast Asia: study

But less than half of consumers are impressed with the digital financial services currently offered.

UnionBank clinches Philippines’ 4th digital bank license

UnionDigital will be a wholly-owned subsidiary of the Philippine lender.

Secret Sauce for the Banking Industry

According to Singapore’s largest bank DBS, the volume of cash deposits and withdrawals fell by an unprecedented 11% in the first 3 months of 2020, a 6% fall from where the figure had been since 2017. Coupled with extraordinary growth in the adoption of e-payments, it’s safe to say that COVID-19 has altered consumer behaviour—and fast.

Four ways to increase share of wallet in the financial services industry

Harish Agarwal, Head of Customer Experience Strategy for SEA, India and Hong Kong, Qualtrics.

South Korean incumbent banks’ profits at risk as Kakao Bank expand loan services

The internet-only bank plans to launch mortgages and merchant loan products.

Liew Nam Soon joins panel of judges at Asian Banking & Finance Awards 2021

For EY's Asean Regional Managing Partner, digital transformation is not an option today, but a necessity that has been accelerated by the pandemic.

Moving forward: Deloitte’s Financial Services Leader on strengthening the financial industry during and after the pandemic

To move forward, the financial services industry should aspire to a "higher bottom line", says Kok Yong.

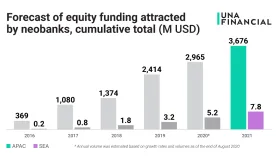

Southeast Asia’s neobank market to grow 50% in 2021

Funding and winding down of the pandemic’s impact on the economy will push this market.

Internet-only lender K-Bank’s users rise by over 2 million in Q2

As of end-June the banks said that it has over 6.19 million customers.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership