Digital banking

APAC neobanking hits $261b in 2025 as mobile use rises

APAC neobanking hits $261b in 2025 as mobile use rises

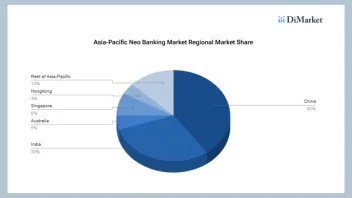

China and India account for 70% of regional market share.

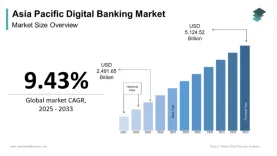

APAC digital banking market to hit $5.12t by 2033

Market Data Forecast projects a 9.43% CAGR through the next decade.

NAB’s Ubank expands Passkeys feature to online banking

The digital bank now enables fingerprint or facial recognition logins online.

Why digital banks are becoming mobile service providers

A compelling neobank operator uses mobile connectivity as a cross-leveraged product.

MAS, banks move to address PayNow surcharge amid fee concerns

Singapore’s central bank says banks must ensure transparency as it reviews surcharges on PayNow.

Digital banking platform market set to grow to $168.3b by 2032

Growth in internet users and the shift to online banking will drive its expansion.

Krungthai Bank and partners establish virtual lender Clicx Bank

Clicx Bank has a registered capital of THB50m to start.

Vietnam’s two-year fintech sandbox takes shape

The trial, which will take effect on 1 July, is a step in the right direction.

ZA Bank reports HK$548m net revenue and narrows losses by 42%

Net interest income is 86% higher in 2024.

Boost Bank targets micro SMEs amidst regulatory, inclusion pressure

The digital bank builds on ecosystem strengths to serve high-risk businesses.

Trust Bank introduces money lock feature with digital unlocking capabilities

They need their app and card to unlock their money.

How banks can make digital transformation work according to Maybank Securities CEO

Clear goals matter, but effective execution defines transformation outcomes.

Omnichannel integration boosts Hong Kong digital payments

Cross-border wallet collaborations are driving digital payments in Hong Kong.

APAC retailers demand seamless, secure payment solutions

As APAC e-commerce grows, retailers seek frictionless and secure payment systems.

GCash expands reach with Mitsubishi and MUFG partnerships

Mitsubishi and MUFG boost GCash’s services and regional presence.

Mastercard advances digital payments with tokenization and passkeys

Tech-driven innovations secures digital transactions and reduces cash dependency in Asia.

Philippines’ population size fuels digital banking interest

Digital banks are driving financial inclusion in the Philippines.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership