South Korea regulator calls for banks to intensify loan assessment: report

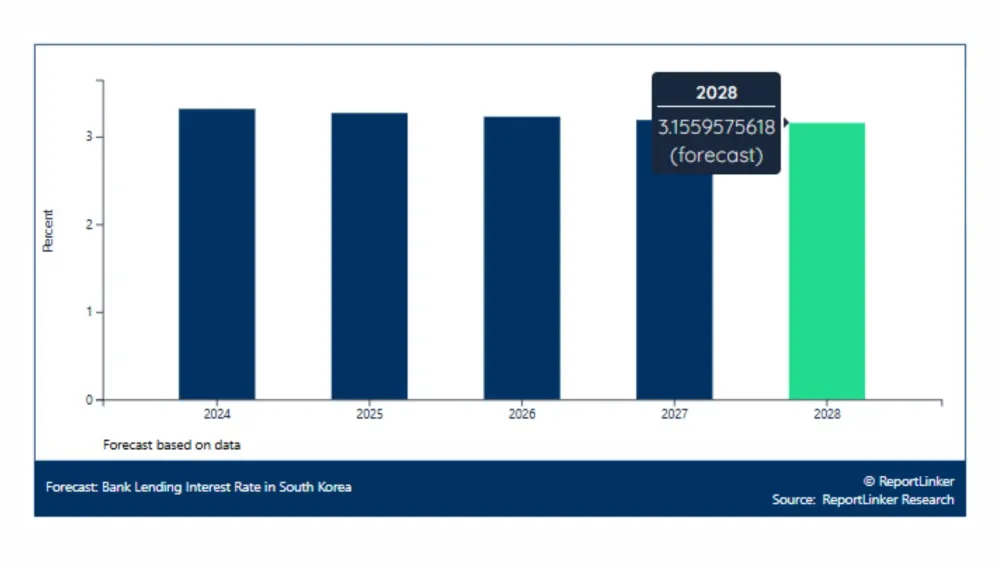

Fast-rising interest rates are expected to hit borrowers’ capacity to repay loans.

South Korea’s top financial regulator called on local savings banks to intensify credit assessment and loan management as fast-rising interest rates hit borrowers' repayment capacities, reports Korean news agency Yonhap.

Banks should better manage their lending to multiple household borrowers, Lee Bok-hyun, head of the Financial Supervisory Service (FSS), told attendees in the latest of a series of gatherings he had reportedly held with financial leaders since taking office in June.

"When coronavirus-related financial support comes to an end and interest rates rise at a full-blown speed, the repayment capacity of borrowers is expected to worsen," Lee said.

READ MORE: South Korea’s deposit, loan interest rates rose in May

He added that “credit assessment and follow-up management on loans made to multiple borrowers should be intensified and loan-loss reserves should also be preemptively set aside to brace for the possibility of such loans going bad.”

Banks have recently raised lending rates following the Bank of Korea (BOK)'s policy rate increase.

Advertise

Advertise