Role of the financial sector towards achieving sustainable development goals in Bangladesh

By Md. Touhidul Alam KhanBangladesh, a country with a high population density, has achieved this accomplishment thanks to the political leadership's passion and commitment to the MDGs, especially at the highest levels of the current Government. The Honorable Prime Minister of Bangladesh has received particular recognition from foreign organizations by being given awards for achieving certain MDG milestones.

However, there are some areas that require more attention, including creating jobs, increasing the number of skilled health professionals present at childbirth, expanding the area covered by forests, utilizing information and communication technology, raising rates of adult literacy and primary school completion, and creating jobs for women that pay a living wage, enhanced water and sanitation management, universal access to modern, sustainable energy, sustainable industrialization, and innovation, action against deforestation, guaranteeing the sustainable use of marine resources, universal access to justice, and strengthening the international partnership for sustainable development. Financial help is necessary in order to successfully transform the entire target area. Here, the financial industry in our country may significantly contribute to its sustainable development.

Green and sustainable initiatives and frameworks are essential for enhancing the sustainability of future development. The larger sustainable development agenda of a nation like Bangladesh includes the formation of sustainable frameworks very extensively. Because of their ability to influence production, business, and other economic activities through their financing activities, banks and financial institutions (FIs) have a special position in the economy. As a result, they have an impact on environmental risk management in the real economy as well as sustainable growth. These organizations have a significant impact on speeding up the transition to a clean environment. These organizations, for example, could establish a "go green" policy and push their client companies to do the same.

In the long-term, this strategy is anticipated to benefit businesses by lowering costs and encouraging access to new markets. All financial institutions should monitor the carbon footprint of their clients or projects to ensure overall sustainability in order to advance their own interests. Mentionable that for the first time, Bangladesh Bank (BB) has defined “Sustainable Finance” for Banks & FIs.

Role of the Financial Sector for Sustainable Development Goals (SDGs) in Bangladesh

A financial sector is a powerful tool for advancing Bangladesh's aims for sustainable development. In order to guarantee a greater standard of living, better education and skill development, faster poverty reduction and job creation, and the transformation of the economy into middle-income status, accelerated financial growth has been proposed as a required development strategy. These ideas, for instance, include the notion that aid, and financial support are essential for Bangladesh, a developing nation, and that the SDGs can only be achieved by leveraging public development finance to catalyze private finance. Worse investment and saving rates, lower human resource quality, lower total factor productivity, and rising land constraints are the main obstacles facing Bangladesh's financial sector in achieving the SDGs. Development in the financial sector is necessary for growth, and growth is necessary for sustainable development.

The growth of the financial sector and the mobilization of resources from it may act as a stimulus for achieving the SDGs, so enhanced resource mobilization from the banking, non-bank financial, semi-formal, and informal sectors take initiatives for development growth. We shall establish a connection between the financial sector and the objectives of sustainable development in this study.

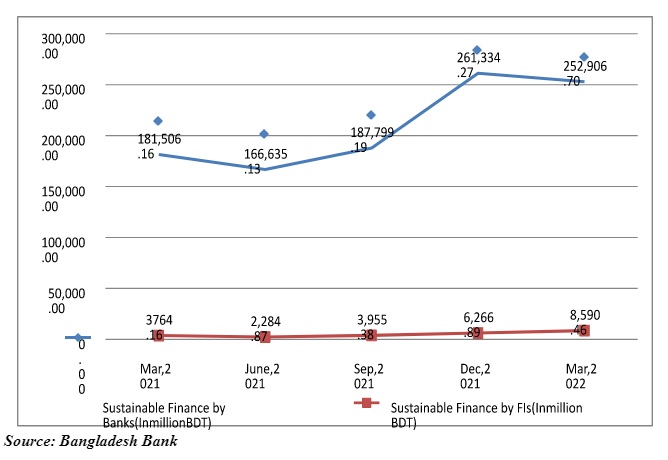

Quarterly Trend of Green Finance & Sustainable Finance

In January-March 2022 period contribution to green finance is BDT 20,985.69 million which is BDT 1300.96 million more than October-December 2021 period. In the contrary, in January-March 2022 period contribution to sustainable finance is BDT 2,61,497.16 million.

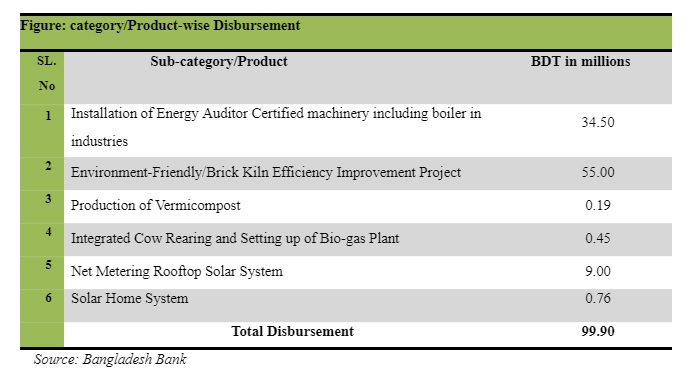

Refinance scheme for environment-friendly products/initiatives

In order to increase the financing options for environmentally friendly products like solar energy, biogas plants, and effluent treatment plants, Bangladesh Bank (BB) established a revolving refinance scheme for solar energy, biogas plants, and effluent treatment plants (ETP) in 2009. With the need for financing of environmentally friendly products and projects on the rise, the fund's size has expanded from BDT 2.00 billion to BDT 4.00 billion. The number of products has increased to 55 under 9 categories. Since the fund's inception, a total of BDT 6,215.92 million has been disbursed as a refinancing facility till March 31, 2022. The disbursement scenario of this scheme during the January-March, 2022 quarter is furnished below:

Sustainable alliances in the financial services sector

The 2030 Agenda offers financial institutions the chance to show how they uphold their social responsibility and satisfy stakeholders, thereby legitimizing their existence. The agenda also offers a business opportunity, too. Financial institutions must make positive externalities from their operations that benefit society. Offer customers sustainable products by changing their business model. This Reorientation, in turn, calls for more open communication with stakeholders and internal changes to the business model. Sustainability reporting is a highly useful tool for this suitable channel. The increasing emergence of coalitions among organizations that share a sustainable business model has verified the ongoing transformation of financial institutions' business models into a commercial strategy, like that of the Global Alliance for Banking on Values (GABV). Founded in 2009, this network seeks “to change the banking system so that it is more transparent, supports economic, social and environmental sustainability, and is composed of a diverse range of banking institutions serving the real economy”. To adhere to the GABV, financial institutions must adhere to five basic principles:

(i) Social and environmental impact and sustainability must be placed at the heart of the business model;

(ii) Operations must be focused on communities, serving the real economy, enabling new business models and meeting real needs;

(iii) Long-term relationships should be established with clients, obtaining a direct understanding of their economic activities and of the risks involved;

(iv) Operations should be long-term, self-sustaining, and resilient to outside disruptions;

(v) Governance should be transparent and inclusive.

Goal 1: End poverty in all its forms everywhere

Over one billion people still live on less than $1.25 per day, despite the fact that we have made enormous progress in eradicating poverty over the past 30 years. If we can't move the noodle on this one, we won't be able to accomplish our other worldwide objectives. By 2030, we must end extreme poverty and cut the number of people in poverty in half.

Goal 2: End hunger, achieve food security and improved nutrition and promote sustainable agriculture

Small farmers all across the world depend on their surroundings, but habitat loss, climate change, and political unrest are depleting their supplies. Aside from producing wholesome food, agriculture, forestry, and fisheries also promote thriving, healthy communities by producing jobs.

Goal 3 Ensure healthy lives and promote well-being for all at all ages

Even though we live in the most technologically advanced era of science and medicine, millions of people still die every year from preventable causes like untreated sickness, drug and alcohol misuse, avoidable birth deformities, and avoidable industrial and traffic accidents. We must ensure that every person, child or adult, has access to the resources they require to live a long and healthy life. Where a person lives or how much money she has shouldn't ever prevent her from obtaining the medical attention she needs.

Goal 4: Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all

More resources and regulations are required as the world's population increases to ensure that every student receives a quality eulachon. The world requires 2 million teachers, and a million additional classrooms will be built to ensure that all students have full access to a quality education. The first step to attaining sustainable development and eradicating poverty is quality education.

Goal 5: Achieve gender equality and empower all women and girls

Every civilization still has significant gender disparities. Many women still don't have access to essential services like health care, education, and jobs, and they frequently face violence and discrimination. The math is straightforward: counties with better equality have lower poverty, greater economic growth, and higher living standards. By removing obstacles to women's participation in economic, social, and political life, we may all have better possibilities.

Goal 6: Ensure availability and sustainable management of water and sanitation for all

More than half of all households have access to clean water at home, but as more people migrate into crowded cities, the number of people without appropriate sanitation (a safe toilet) is rising. Every year, illnesses brought on by tainted water claim more lives than all types of violence combined, including war. Millions of people's lives and health can be improved by placing a priority on having a clean wallet.

Goal 7: Ensure access to affordable, reliable, sustainable, and modern energy for all

Not only is clean, renewable energy better for the environment, but 43 million individuals die annually. Every year pollution is caused by fire or harmful fuels used in domestic cook burners. These fatalities are absolutely avoidable, so we must ensure that everyone has access to renewable energy by 2030.

Goal 8: Promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all

Both the quantity and quality of jobs worldwide have been negatively impacted by the economic recession. The availability of jobs is essential for economic growth and more equitable income distribution for the 190 million unemployed. For civilizations to be secure and stable, economic development and chances for gainful employment are essential.

Goal 9: Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation

Developing nations are unable to maximize the use of their available natural resources and human labor without the proper infrastructure and technology. Innovation and research, which are essential for job creation, the eradication of poverty, gender equality, labor standards, and increased access to healthcare and education, are greatly aided by industry. We can advance inclusive and sustainable industrialization and technological advancement by working together.

Goal 10: Reduce inequality within and among countries

Without equal possibilities for all nations and their populations, we cannot live in a world that is fully developed. All of the sustainable development goals are based on equality. Together, we can encourage and enable all individuals to participate in social, economic, and political life, regardless of their ages, sexes, disabilities, ancestry, ethnicity, religion, economic status, or other characteristics.

Goal 11: Make cities und human settlements inclusive, safe, resilient, and sustainable

Nearly 60% of the world's population will reside in urban areas by 2030, with the majority of this urbanization taking place in developing nations. Rapid urbanization puts a strain on freshwater supplies, sewage systems, the quality of life, and public health. The advantages of technology and society should be welcomed.

Goal 12: Ensure sustainable consumption and production patterns

Sustainable production and consumption are all about getting more done with fewer resources. By 2050, it is anticipated that there will be ten billion people in the world, further straining its limited resources. In order for everyone, including our grandkids, to enjoy a high standard of living with access to food, water, electricity, and other necessities, we must encourage sustainable lifestyles.

Goal 13: Take urgent action to combat climate change and its impacts

By burning a lot of fossil fuels over the past 150 years, the industrialized world has altered the balance of the planet's carbon cycle. Climate change has the potential to thwart other efforts toward sustainable development by altering weather patterns that threaten our food production and rising sea levels that will uproot coastal communities. In order to start tackling climate change before it is too late, we need to raise awareness and emphasize the urgency to global leaders.

Goal 14: Conserve and sustainably use the oceans, seas, and marine resources for sustainable development

Human actions like marine pollution, overfishing, and habitat degradation are endangering and destroying our oceans and seas. Nearly 200,000 species can be found in the oceans, which make up three-quarters of the surface of the planet. More than 3 billion people depend on the beauty of marine and coastal biodiversity for their lives. If we move fast to maintain and safeguard our marine resources and habitats, we can stop and undo the harm we have done to the oceans around the world.

Goal 15: Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss.

Biodiversity is dwindling due to pressures from our expanding global population, urbanization, and climate change. The majority of developing nations rely on wild animal meat for food. In order to stop ecosystem imbalance, land degradation, and food insecurity, we must act to restore and maintain our planet's biodiversity.

Goal 16: Promote peaceful and inclusive societies for sustainable development, provide access to justice for all, and build effective, accountable, and inclusive institutions at all levels

Only with more inclusive and peaceful societies can we hope for a more fair and sustainable world. Therefore, we must lessen crime, violence, and exploitation. The illicit trade in weapons and goods must stop. The public institutions on which we all rely must be efficient, open, and responsible.

Goal 17: Strengthen the means of implementation and revitalize the global partnership for sustainable development

These 17 objectives' accomplishment is not some idealistic fantasy. Global objectives have been proven to be effective in the past, so we are extending the scope of the new goals to address the underlying causes of poverty. We have the resources and expertise to win this battle, but only if everyone realizes how close we are.

Conclusion

Banks have a significant role in aiding the broader economy's adaptability to environmental changes in addition to managing their own risks. By redistributing credit to the economy's most sustainable sectors and controlling credit. Banks lessen the chance of a negative effect on the environment, market risks, and sustainability, lessen the effects of any potential harm, and support the afterward recovery. Banks may use the "green banking model” to reduce these risks using strategies like the Equator Principles or by joining sustainable banking partnerships. Norms like the Equator Principles facilitate banks' integration of environmental and social credit and operational concerns of major infrastructure into their assessment’s investment initiatives.

The consideration of sustainability-related factors in Bangladesh affects the institution’s risk-adjusted capital ratio (comparing total adjusted capital to the risk-weighted assets held) and its CAMELS rating (a composite value reflecting six areas: capital adequacy, asset quality, management skills, earnings, and profitability, liquidity risk, and sensitivity to market risk).

From the national-level coordination in Bangladesh perspective, international collaboration, and international coordination, it is imperative to provide a safe and sustainable financial future for everyone. The central bank (i.e., Bangladesh Bank) of the country has made a paradigm change in response to this fact by adopting a sustainable finance policy for banks & NBFIs. The COVID-19 scenario had a significant impact on the country during the quarter under evaluation after the policy was implemented.

Advertise

Advertise