DBS rolls out one-stop sustainability-focused platform

The bank will also launch an autonomous carbon calculator service under LiveBetter.

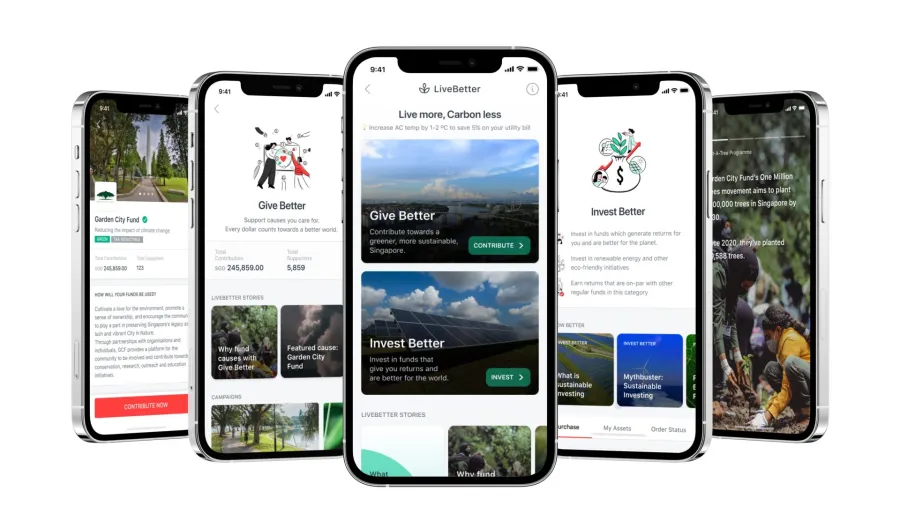

DBS launched LiveBetter, a one-stop digital service offering eco-friendly tips as well as resources to donate to local green causes and invest in sustainability-themed funds.

The platform is currently available to all DBS/ POSB customers in Singapore through DBS’ banking app.

The bank is also rolling out an autonomous carbon calculator service under LiveBetter by January 2022. It will automatically generate carbon footprint profiles and insights based on customer spending patterns.

DBS further shared that it is developing a function that will reportedly enable customers to purchase carbon credits to offset their carbon footprint.

Findings from the DBS Consumer Sustainability Survey, which surveyed over 1,000 Singapore residents aged 18 and above in July 2021, found that 93% of respondents are aware that their activities contribute to carbon emissions and 86% are aware that their carbon footprint will impact the world.

However, the study also found that many are unlikely to take action towards sustainable living: 73% are willing to change their lifestyle to live more sustainably, but only if it’s convenient for them; whilst 31% are undecided as to whether they will reduce their carbon footprint.

A third or 33% also cited having difficulties finding the right channels to learn about sustainability.

Advertise

Advertise