Mark Billington: Accounting standards set for convergence detour?

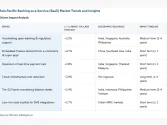

By Mark BillingtonSeveral Asian countries, including Singapore, Malaysia, Korea, India and Japan, are currently going through the final stages of adopting International Financial Reporting Standards (IFRS). These are important steps towards achieving the vision of establishing a global set of high-quality accounting standards, as requested by the Group of 20 leaders.

An important argument for global uniform accounting rules is that it would increase transparency and allow investors and other stakeholders to compare companies' financial performance not just across industry sectors but also across country borders.

Bumpy road ahead

Despite the rapid spread and adoption of IFRS globally, there are bumps on the road ahead. The biggest bump is represented by the challenges faced by the project to converge IFRS with US Generally Accepted Accounting Principles (US GAAP). The two standards setters responsible for IFRS and US GAAP, the International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB), have to overcome several challenges if they are to meet the June 2011 deadline of converging the two sets of accounting rules.

The challenges include the fact that the two sets of rules are fundamentally quite different; US GAAP is more detailed and prescriptive than IFRS and the rule book stretches to more than four times the length of the IFRS rule book. Another reason is that the two Boards have rather differing views on how financial instruments – deemed the most complex and controversial area of financial reporting – should be accounted and also that their timelines for reforming these standards are not synchronised.

At the last G20 meeting in the US in September 2009, the world leaders urged the IASB and the FASB to re-double their efforts to achieve convergence by 2011. Since January the two Boards have met on a monthly basis to try to iron out the main differences and in April they published a quarterly update on the progress made. Whilst it stated that they are on track to achieve the target, it also suggested that the timings of several draft standards will slip due to the Boards' differing views. Furthermore, it said that there is no guarantee that they will be able to resolve the differences relating to the financial reporting of financial instruments.

The efforts by the two standard setters will shortly be firmly put in the spotlight again, as the FASB is expected to publish its comprehensive proposed standard for the classification and measurement of financial instruments, including impairment and hedging, in May. FASB's proposal is expected to take a different approach to the IASB's counterpart standard, IFRS 9, which was published at the end of 2009. Where the IASB has opted for a mixed measurement model, using both amortised cost and fair value, the FASB is aiming for a narrower, fair value based approach. In other words, it looks as if they are about to send the convergence project on a major detour over the next few months. This is very unfortunate, as agreeing on one set of high-quality global accounting standards is not a nice-to-have but a must-have in today's increasingly global business environment. In the ICAEW's view, a mixed approach is the best approach.

Why does it matter?

For IFRS to become a truly global set of accounting standards, it is important that the US, as the world's largest capital market, comes onboard. And whether that will happen, hinges to a great extent on the success of the two standards setters’ convergence project.

The US regulator, the Securities and Exchange Commission (SEC), published in February a statement on its ‘IFRS Roadmap’ (ending 15-months of near-silence on the subject), outlining its continued support for a single set of high-quality globally accepted accounting standards and its ongoing consideration of incorporating IFRS into the US reporting regime. However, the decision on whether the US will adopt IFRS, and when that might happen, is still to be confirmed and depends on whether the SEC in 2011 thinks that the IASB and the FASB's convergence project has brought about sufficient narrowing of the gap between the two sets of standards.

In other words, the imminent proposal by the FASB is something that has the potential to have a major impact on businesses, accountants, auditors, regulators and other stakeholders across the world.

Good things come to those who wait...

The fact that the US' view weighs so much in this debate is something that several constituents in Asia have questioned. The Japanese regulator has, for example, indicated that it is not keen for international standards to be brought closer to US GAAP. An Asian-Oceanian Standards Setters Group was also formed last year to allow the region's standards setters to play a more active role in relation to the IASB's work.

Detour or not, amending accounting standards takes time. It is important that due process is followed to ensure that all stakeholders have had a chance to share their views and to avoid any adverse effects. It is critical that the drive towards a single, global set of high-quality accounting standards remains a priority and that IFRS countries around the world over the coming year ensure that the final push for IFRS/US GAAP convergence, important though it is, does not damage the quality of international standards.

For more information on IFRS, visit the ICAEW Financial Reporting Faculty at www.icaew.com/frf.

Advertise

Advertise