Mobile payments boom as banks, fintechs collaborate

Find out how DBS, Maybank, OCBC, and Bangkok Bank partner with fintechs to bring a better user experience in the payments space.

When DBS unveiled a sprawling 16,000 sq ft innovation space in Singapore called DBS Asia X (DAX) in late 2016, it wanted to attract fintechs to build their bases in it through a strategy that is increasingly in vogue in Asia: nurturing close-knit collaborations with startups and birth innovations that would elevate the bank’s lucrative cards and payments business. DAX was replete with all the facilities and trappings that a fintech startup would need such as project pods, co-working spaces, an auditorium and even a café.

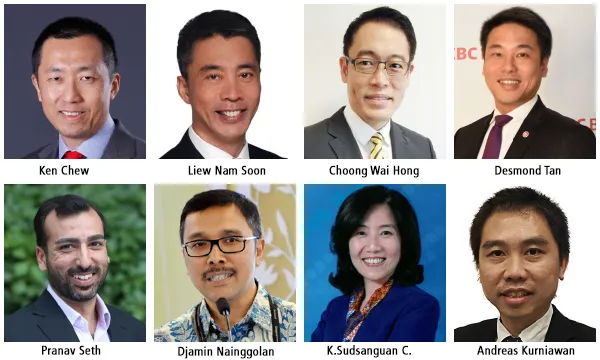

Aside from DAX, DBS has built other smaller collaboration spaces such as a dedicated 5,000 sq ft co-working space in Wan Chai in Hong Kong. Ken Chew, managing director of consumer finance, consumer banking group and wealth management at DBS Bank (Hong Kong) Limited, says the space has been pivotal in the bank’s efforts to partner with startups from the DBS Accelerator Programme, which was launched in 2015 to support startup businesses and entrepreneurs looking to bring in breakthrough innovations in the world of finance. The startups that step into the accelerator programme are housed in a productive work environment, receiving a stream of managerial and advisory support from DBS executives.

“Leading banks have established their own fintech or innovation labs to provide platforms to work with fintech players through accelerator or incubation programmes,” says Liew Nam Soon, managing partner for financial services ASEAN at EY. He notes that DBS has been actively engaging in the fintech ecosystem with programmes and the DBS HotSpot, a pioneering pre-accelerator programme in Singapore, has attracted more than 40 startups.

Citi has also created a new unit called Citi FinTech, which is at the forefront of forging collaborations with fintech startups. The unit holds a Citi Mobile Challenge, a hackathon series that searches for the best ideas in the world that can be incorporated in Citi mobile banking apps. “I think such initiatives give the banks more control and oversight on how the innovation is built, how it may be monetised as well as how the innovation is integrated into their businesses, processes and systems,” says Liew.

When fintech players arrived on the scene, banks felt an initial shock of competition as their lines of businesses were threatened by technologically savvy rivals. But many banks seem to have adopted a more collaborative stance with fintechs, not only with startups but also with big players as well, in the field of mobile wallets and contactless payments.

Chew says in the past years DBS has worked with Apple, Google, and Samsung to launch various mobile wallets. It has also teamed up with Tencent on WeChat Pay. “We believe the new economy is one that’s collaborative,” says Chew. “By working with fintechs we are able to bring down the cost of technology, create a symbiotic partnership and bring a better user experience to the consumers.”

More collaborations

Maybank, for its part, launched the Maybank Samsung Pay wallet facility in Singapore last August on the back of a very high mobile penetration rate across the island, as well as the growing support for and usage of cashless payments by both shoppers and merchants to complete transactions, says Choong Wai Hong, head, community financial services at Maybank Singapore.

“Payment modes have been evolving rapidly over the years, more so in recent times as digital technology has become increasingly widespread. Maybank’s venture into the new payment mode was essentially based on a number of important trends that were gathering strong momentum,” he says.

“Mobile is core to the Singapore customer’s lifestyle,” says Desmond Tan, head of group lifestyle financing at OCBC Bank, on why mobile wallets have become a major trend in Singapore. “For certain segments, like our FRANK by OCBC customers that are extremely mobile-savvy and are open to trying out new technologies, new payment form factors are of significant appeal.”

He says that with more than half of Singaporeans owning a credit or debit card with contactless payment capabilities, it was logical to start extending this convenience to their phones. “The advantages of going cashless are vast. The convenience of a digital wallet removes the need to bring along multiple cards, cash or even a physical wallet. A mobile device can become the single point of usage when it comes to making payments. Still, customer adoption is a key factor in its success and in moving the needle on cashless payments,” says Tan.

Pranav Seth, head of e-business, business transformation and fintech and innovation group at OCBC Bank, says the popularity of mobile wallets shows that a broader banking movement towards continued simplification, as seen in the proliferation of simple click-to-chat interfaces, frictionless biometric authentication of transactions and hyper-customised products and services. He expects many new entrants in the payments space, but even if this exerts some pressure on margins, the key to success will be to become the most innovative and efficient payments provider for customers, part of which will hinge on cementing collaborations with fintech startups.

“We continue to explore partnerships with startups that work jointly with us to help us achieve our objective of providing solutions that customers need and want,” says Seth.

Seeds take root in Southeast Asia

Beyond Singapore and Hong Kong, fintech collaborations in mobile wallets and other services is also taking root in Southeast Asia. Last year, Indonesian bank Danamon formed a partnership with Investree, a fintech company that provides peer-to-peer lending via Internet and mobile devices. “Collaboration with fintech companies enable banks to enter into new types of markets,” says Djamin Nainggolan, consumer lending head at Danamon. “Banks have the experience in managing credit risk and have a bargaining power in collaborating with fintech companies.”

Bangkok Bank has likewise partnered with fintech mobile wallets, although it still continues to enhance banking products that provide as similar proposition, says Dr Sudsanguan Chusacultanachai, executive vice president at Bangkok Bank, presumably as an alternative to customers who do not want to shift to using mobile wallets.

These enhancements to traditional products include offering virtual cards that can be stored and used via mobile devices, and adding mobile payment functionalities – such as via QR code – to account base products. Asian banks are jumping into the mobile wallet bandwagon not only because of the spike in technological innovations such as contactless payment technology brought on by fintech players, but also because of changing consumer habits.

Other initiatives

In June, Maybank also launched Maybank Sandbox, a regional fintech sandbox for ASEAN. Choong says the sandbox is the first of its kind in Asia and will leverage on the bank’s position as one of the first banks to collaborate with fintechs through Maybank Fintech and hackathons. “It will provide opportunities for startups and innovators to develop and test new ideas. It provides all the essential components for free, to fast-track the growth of fintech developers across the region,” he says.

In Indonesia, the seeds of fintech partnerships in the field of mobile payment and electronic money are already taking root, with OCBC NISP revealing plans to collaborate with key financial players with capabilities and infrastructure in those two areas to push out “an electronic money in the form of a prepaid card,” says Andreas Kurniawan, retail business development head at OCBC NISP.

“By collaborating with fintech and other financial players instead of in-house development, we could cut back on development costs. OCBC NISP views fintech companies as opportunities as opposed to threats. By collaborating, we can leverage fintech companies’ simplicity, scalability, and innovativeness in improving our customer propositions,” adds Kurniawan.

Advertise

Advertise