SG fintech Volopay targets to triple revenue by June 2024

Rising above the pandemic, varying regulations, and talent pool challenges, Volopay sets an ambitious goal to expand operations.

Driven by the mission to integrate overall business spending in a unified platform, Volopay Co. is keen to fully deliver in the complex financial technology (fintech) environment of today.

The Singapore-based fintech company is a business-to-business digital platform that saturates all the essentials a business needs in an automated system and accommodates companies with 25 to 1,000 employee accounts.

Beginning its commercial operations in 2020 when COVID-19 broke out, Volopay weathered through the global standstill and even grew its business to become the fourth most popular fintech company in Singapore, based on the Crunchbase report of 27 April 2023.

Interviewed by Asian Business and Finance via Zoom, Rohit Bhageria, Volopay founding member and external vice president, recalled how their idea for the company was simple and rooted in a single problem: software and banks felt disconnected.

Primarily, this is because business essentials for spending and financial management are segregated in nature, Bhageria elaborated.

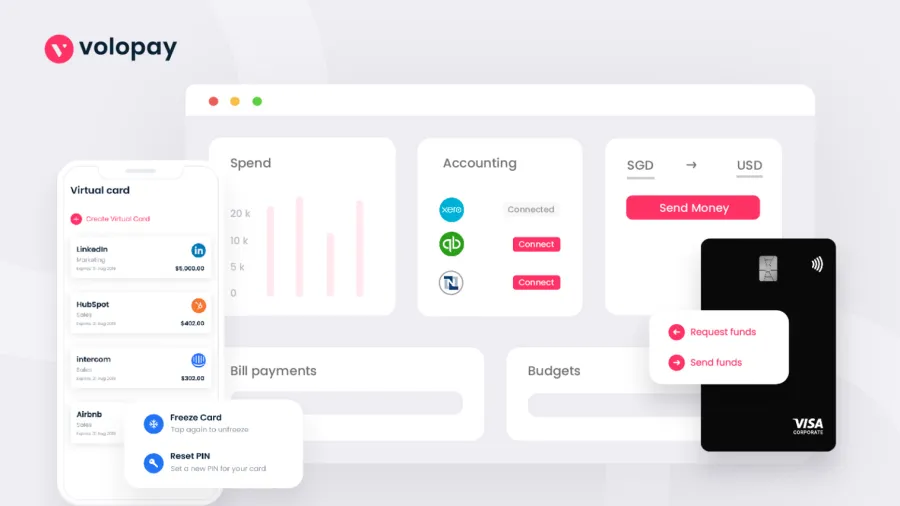

“What we have done is, we have built this all-in-one unified payable and receivable management software comprising banking payments, corporate cards, expense management, and workflow approval tools, which syncs with the accounting software in a single click on a single unified platform,” Bhageria said.

Voloplay’s technology has provided businesses full management control in one program.

One smart manoeuvre for Volopay was branching out in the Australian market in 2021 and then on to Indonesia and India in 2022.

Overcoming challenges

As with every business, different consumer needs arise and varying geographical regulations rise even higher – a situation Volopay had to win over as it expanded operations to other countries.

“[Volopay] is a very ambitious project. But from a geographical perspective, all the banking software is subject to local regulations,” Bhageria said.

ALSO READ: MAS gives IPA to Volopay for MPI license

The ideal vision for Volopay is to serve global needs whilst complying with regulatory frameworks. “The regulatory environment or challenges of all the countries are so heterogeneous in nature, that it requires multiple fintech companies to operate,” Bhageria added.

Despite facing challenges posed by geographical and regulatory differences in various markets and the COVID-19 pandemic, Volopay remained resilient.

“If I am operating this business in Europe, then in Cyprus or Malta; and from Cyprus and Malta, I can cover the entire European Union. Because there is the ‘passporting’ of the bank identification number. But whereas if I am operating in a market like the Asia Pacific, I need to stitch this solution as per the local regulatory environment,” Bhageria explained.

Based on the TMF Group’s Global Business Complexity Index 2022, APAC countries have one of the most complex environments relative to other regions, but this was mainly driven by the harsh outcomes of the pandemic in the previous years.

“We call ourselves a ‘COVID infant.’ It was very difficult to conduct face-to-face meetings with clients, as it relatively becomes difficult to establish trust. And so we built a very strong customer success team,” Bhageria recalled.

On the back of the customer success team, Volopay committed “365 days on the table” just to attend to the needs of its clients. So, the company had to source out great talents to build a great team.

“Heavily funded startups attracted a very great talent pool during 2020 and 2021. But due to the tough economic environment beginning in 2022, the talent was most likely to run towards the safety of big established firms or financial institutions,” Bhageria said.

The company’s workaround to entice new talent was its three mantras: first, Volopay kept a flat or horizontal management structure, removing the hierarchy factor that most businesses have; second, it entrusted heavy responsibilities to those in the younger stalwarts; and lastly, the firm gave its employees the autonomy to execute tasks quickly.

Volopay projects its future

Confidently, Bhageria declared that Volopay would triple its annual recurring revenue (ARR) by June 2024.

In April 2023, an in-principle approval (IPA) for a major payment institution (MPI) license was issued by the MAS, the central bank of Singapore. Beginning with the IPA, Volopay’s services will be regulated under the state’s Payment Services Act.

Bhageria said this license will allow the company to operate an end-to-end stack including their front-end digital experience and integrate digital customer onboarding. Further, this will enable Volopay to have direct card issuance capabilities.

Moving forward, Volopay is constructing a robust product roadmap. The fintech firm targets to strengthen its existing product offerings and to develop more around these by the end of 2024.

The tech firm is also eager to enter more markets in Southeast Asia, such as the Philippines and Vietnam.

In the short term, Bhageria said Volopay dreams to scale up the business in order to achieve EBITDA profitability.

Advertise

Advertise