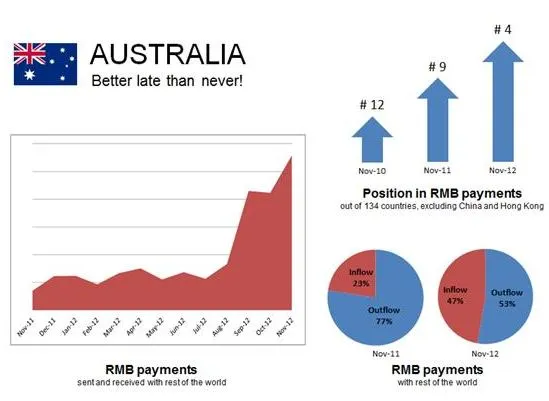

Australia ranks 4th in RMB centres list

The list excludes China and Hong Kong.

According to SWIFT, RMB payments by Australia really shot up since August 2012 after a period of relatively low volumes propelling the country from position #12 to #4, over a two year period from Nov 2010-Nov 2012 (excluding China and Hong Kong).

While initially mainly driven by RMB outflows, the RMB inflows are now nearly as important. Overall, RMB payments grew by 24% between October 2012 and November 2012 (versus average decrease of 7% across all currencies), moving the RMB back up two positions to become world currency #14 with an all-time high market share of 0.56% (versus 0.42% in October 2012).

The following reflects the top 5 RMB centres excluding China and Hong Kong:

1. UK

2. Singapore

3. France

4. Australia

5. United States

Advertise

Advertise